How to Check Individual / Company TIN in Malaysia via MyTax Portal TIN Search Service

Starting January 1, 2025, the Inland Revenue Board of Malaysia (LHDN) has introduced a new feature on its MyTax portal, enabling individuals and businesses to verify taxpayer’s Tax Identification Numbers (TIN) online. This TIN search service supports the government’s initiative to enhance tax administration and facilitate the implementation of electronic invoicing (e-Invoices).

What exactly is a TIN (Tax Identification Number)?

The Tax Identification Number (TIN) is a unique number assigned to individuals and businesses for tax purposes. This number, comprising a prefix code and a set of numbers, enables the Inland Revenue Board (IRB) to identify taxpayers. The Tax Identification Number is also referred to as the INCOME TAX NUMBER as per existing records with the IRB.

Who needs a TIN Malaysia?

Individuals

- Residents: All residents in Malaysia, regardless of their citizenship, are generally required to have a TIN for income tax purposes.

- Non-residents: Non-residents earning income in Malaysia also need a TIN if their income is subject to Malaysian taxation.

Businesses

- Companies: All companies registered in Malaysia are required to have a company TIN.

- Partnerships: Partnerships engaged in business activities in Malaysia typically need a TIN.

What is the TIN Search Service?

The TIN Search Service is designed to make it easier for individuals and businesses to confirm the validity of TINs. The use of the TIN search function is strictly for purposes allowed under the ITA 1967. Any misuse of the service may result in penalties under existing regulations.

How to Use the TIN Search Service on MyTax Portal

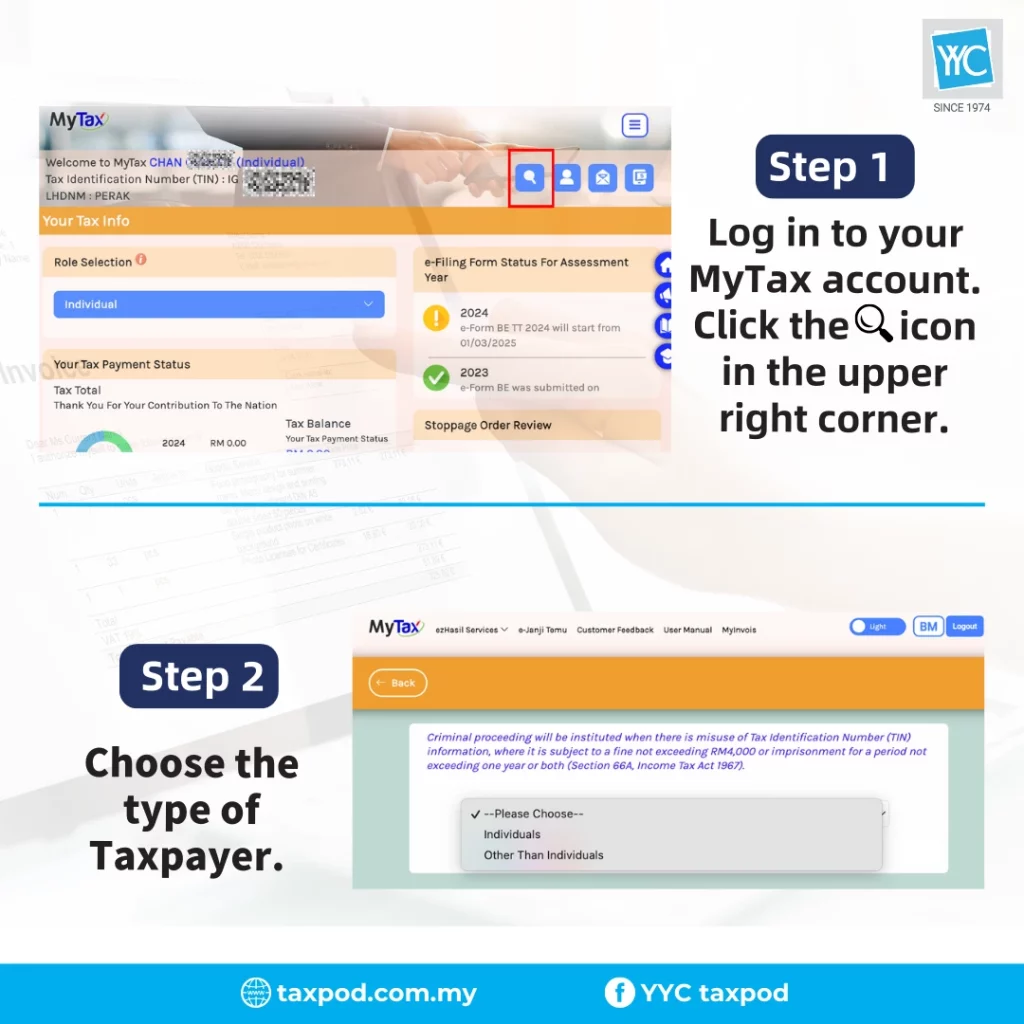

Taxpayers can access the TIN verification service through the MyTax portal by following these steps:

- Access the MyTax Portal

Visit the MyTax portal at https://mytax.hasil.gov.my and click on the ‘search’ function in the top-right corner. - Choose the Relevant Category

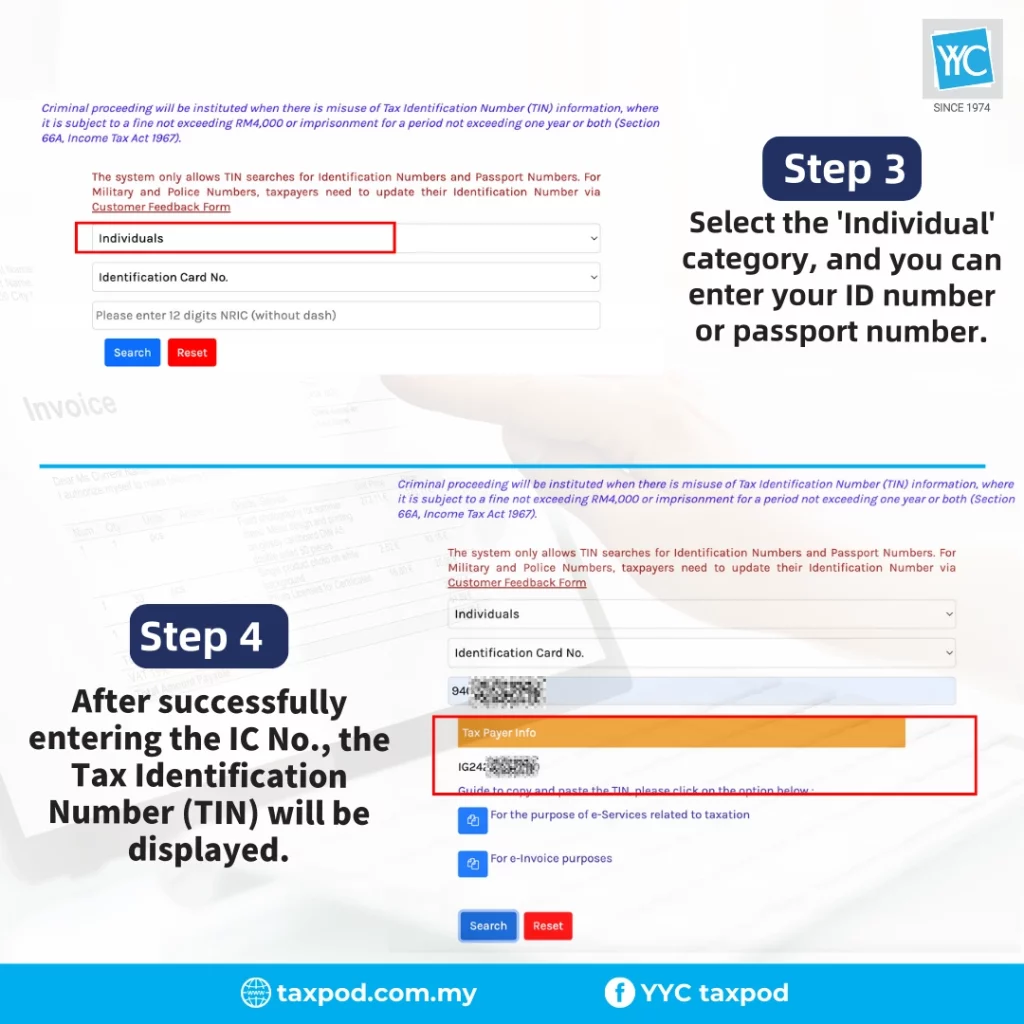

- For individuals, select “Individuals”.

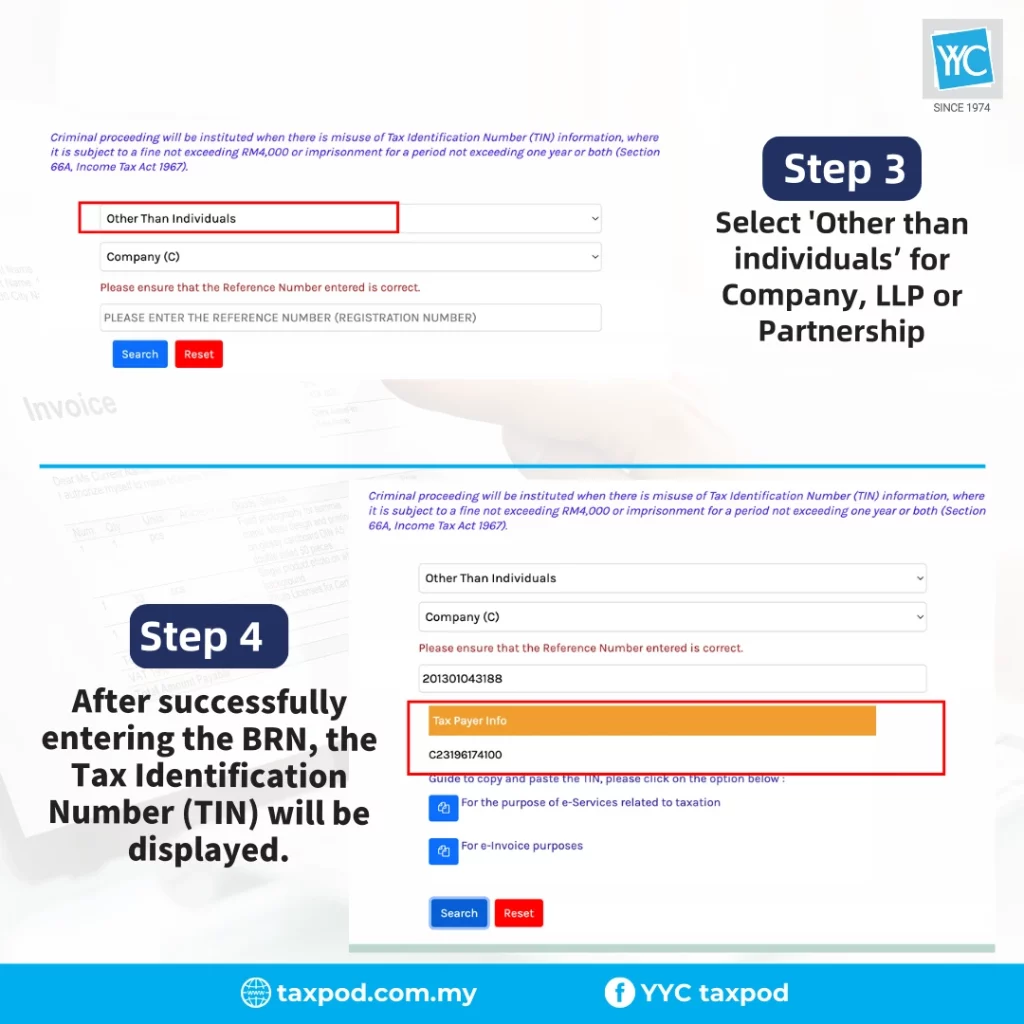

- For entities other than individuals, select “Other Than Individuals”.

- Input Identification Details

- For individual taxpayers, enter the Identification Card Number (NRIC) or Passport Number.

- For non-individual entities, provide the Business Registration Number (BRN).

- For individual taxpayers, enter the Identification Card Number (NRIC) or Passport Number.

- Perform the Search

Click the Search button to retrieve the corresponding TIN details.

Benefits of the TIN Search Service on MyTax Portal

The new TIN search functionality provides several advantages:

- Ease of Use: Taxpayers can verify TINs from anywhere, eliminating the need for physical visits to LHDN offices.

- Improved Tax Compliance: With instant TIN verification, individuals and businesses can ensure they meet their tax obligations accurately.

- Support for e-Invoicing: This service facilitates the transition to electronic invoicing, a significant step toward modernizing Malaysia’s tax ecosystem.

Key Considerations When Using TIN Search Service via MyTax Portal

The TIN search feature is strictly for purposes permitted under the Income Tax Act 1967. Any misuse of the service may result in penalties in accordance with existing regulations.

How to Obtain a TIN Malaysia?

TIN can be obtained through the following methods:

- Automatic Registration:

- Registration of income tax numbers for individuals will be done automatically through monthly tax deduction (MTD).

- Newly incorporated companies (local or foreign companies) that have registered online with the Companies Commission of Malaysia (SSM).

- Online Registration:

- Through the e-Daftar system in the MyTax Portal.

- Through the e-Daftar system in the MyTax Portal.

- Manual Registration:

- By visiting a nearby IRB branch.

How TIN Ensures Compliance and Security in e-Invoicing

A Tax Identification Number (TIN) is crucial in e-invoicing for several reasons:

- Unique Identification: The TIN acts as a unique identifier for both businesses and individuals, allowing the IRB to accurately track and verify each taxpayer’s transactions.

- Facilitating Automated Processes: e-Invoicing systems often rely on the TIN to automate the validation and processing of e-invoices. This ensures that the invoices are correctly associated with the right taxpayer.

- Prevention of Fraud: By requiring the TIN on e-invoices, the IRB can minimize the risk of fraudulent activities, such as using false identities or making duplicate claims for tax refunds.

- Improved Business Credibility: Possessing a valid TIN enhances the credibility of a business. It shows that the business is registered and compliant with tax regulations, which can build trust with suppliers, customers and partners.

Conclusion: e-invoicing Made Easy with MyTax Tin Search Service!

The launch of the TIN search service on the MyTax portal marks a significant milestone in Malaysia’s tax administration reforms. By simplifying the process of TIN verification, the government aims to enhance efficiency, improve tax compliance, and support digital transformation efforts. Taxpayers are encouraged to familiarize themselves with this service to ensure a seamless transition to the modernized tax system.

For more details, visit the official MyTax portal at https://mytax.hasil.gov.my.

Level Up Your Tax Game with YYC taxPOD

You can always learn more via the YYC taxPOD platform!

YYC taxPOD is Malaysia’s premier online tax education platform, providing expert guidance from a team of experienced professionals. Access comprehensive tax courses, stay updated on the latest tax laws and regulations, and gain valuable insights to optimize your tax planning.

Visit YYC taxPOD now and sign up for a taxPOD demo!