Our Features

Bite-Sized Learning Videos

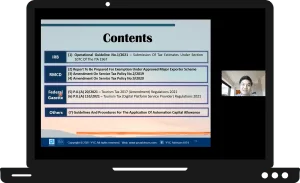

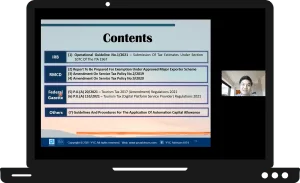

Monthly Tax Update Classes

Interactive and Engaging Learning Materials

Full coverage SST, e-Invoice and Other Popular Tax Areas

What’s The Catch?

There is no catch. Here’s a sample video for you to see exactly what you will get.

But Why Did You Just Give Me That Advice For Free?

Why wouldn’t we? There’s lots more where that came from

Meet Your New Tax Advisors

The YYC taxPOD team is led by tax advisors with over 75 years of combined experience in the tax industry. Our professionals have been involved in tax compliance and tax advisory work in various fields ranging from manufacturing, trading (retail & business services), franchisor/licensor, education, investment holding, investment dealing, forestation, agriculture, foundation, association and trade union. They are bilingual speakers (Mandarin and English) who regularly give tax-related talks and seminars that have benefitted over 12,000 individuals to-date.

Get A Good Tax Agent For Tax Submission?

By the time you close accounts and pass it on to your tax agent, it will be too late to change anything.

Learn To Do It Yourself?

Yes! You make important business decisions every day. Ignoring the tax implications of those decisions could be costing you thousands of unnecessary tax paid every year.

Engage Tax Advisors For Advisory Services?

Sure, but to deliver the best advice, tax professionals need to spend time and effort to understand exactly how your transactions work. One engagement could easily cost you tens of thousands of ringgit.

Hire A Tax-Savvy Accounts Staff?

Yes! However, they are quite rare (and often not cheap!). We find that training accounts staff who already understand your business to be tax-savvy is faster and more effective than outside hires.

No Long, Boring Reports

Hear it directly from our tax professionals as they deliver essential tax planning knowledge to you through bite-sized videos.

Unlimited Playback With Downloadable Course Materials

Watch our videos wherever, whenever, and as many times as you want. You get to download and keep the course materials too!

Up-To-Date Tax Planning

Did you know that the Inland Revenue Board of Malaysia and Royal Malaysian Customs Department made 78 announcements and updates in 2020 alone? Our monthly live tax update classes will keep you up to speed.

Still Have Tax Questions?

Ask us during our live webinars. You get access to our tax-related webinars all year round, with no limit to how many times you want to join a webinar.

Practical Case Studies

We drive home tax concepts through case studies tackling specific issues you’re likely to face in day-to-day operations.

Wide Pool Of Information

We leverage on the data we have accumulated from our experience in serving thousands of tax clients from various industries.

TaxPOD Masterclass

TaxPOD Masterclass videos are playable directly on our platform.

Live Tax Webinars

Our live webinars are delivered via Zoom – register easily through our platform!

TaxPOD Masterclass

TaxPOD Masterclass videos are playable directly on our platform.

Live Tax Webinars

Our live webinars are delivered via Zoom – register easily through our platform!

Pricing

It’s Time To End Your Tax Nightmare!

YYC taxPOD

- 100% HRDC Claimable

Eligible for Claiming CPE hours - YYC taxPOD Bite-Sized Learning Videos – RM 10,888 value

- 12 YYC taxPOD Revision with Q&A (Live + Recording) – RM 2,256 value

- 12 Monthly Tax Update Class (Live + Recording) – RM 10,656 value

- 6 Popular Tax Webinars (Live + Recording) :

- Budget Conference Webinar – RM 888 value

- Company Tax Savings Webinar – RM 688 value

- Transfer Pricing Webinar – RM 688 value

- Tax Audit and Investigation Webinar – RM 688 value

- Withholding Tax Webinar – RM 688 value

- Essential Tax Planning for Property Owners Webinar – RM 688 value

- Hot Trending Topic Webinars (Live + Recording) – RM 4,656 value

- E-invoicing Mastery Course (Live + Recording) – RM 2,500 value

Frequently Asked Questions

YYC taxPOD, or Tax Professionals On Demand, is a platform developed by YYC that offers unlimited access to decades of our tax-saving knowledge. It gives you unlimited access to our taxPOD Masterclass videos, 12 monthly live tax update classes, and live tax webinars all year round. Our courses cover various topics related to Malaysia tax as well as corporate tax Malaysia.

Remember, once you have paid out the money for company tax, you will never be able to get it back! Ever! YYC taxPOD is here to help bosses like you not to pay even a single cent of unnecessary tax! We cover essential topics related to income tax Malaysia.

»Learn How to Get a 100% Tax Deduction!

Example 1:

You invited your clients to an event that you organised for a special occasion. Initially, the entertainment expense incurred was only entitled to a 50% tax deduction. However, if you had managed to make it into a sales event with proper planning, then the expenses would have been 100% tax-deductible! That would have made a huge difference!

»Learn How to Strategise Your Tax Estimation!

Example 2:

A customer recently overpaid his tax, which amounted to RM 500k, due to his lack of knowledge in tax estimation. He had no income during the MCO as most of his projects were halted. Unfortunately, the IRB seized his RM 500k cash flow, and he only managed to retrieve it after a very long time.

You should never pay more advance tax than necessary just because you are afraid of getting penalised by the IRB! How do you prevent that from happening? Well, you can learn various tax estimation strategies via our YYC taxPOD platform.

While our case studies primarily focus on companies (Sdn Bhd), YYC taxPOD is also valuable for sole proprietorships and partnerships. The core tax concepts covered, such as the taxability of income, Malaysia tax rate, company tax rate, and the deductibility of business expenses, are applicable across different business structures.

A significant portion of your business’s profit is allocated to tax expenses, making it essential for you as a business owner to lead the charge in managing company taxes, including corporate tax obligations and deductible business expenses. Your active involvement and concern for tax matters not only demonstrate your commitment but also set a powerful example for your employees. This influence encourages them to prioritize and understand tax issues as well.

Credit and debit cards

We accept Visa and Mastercard; American Express is not supported at this time.

Please note that for Malaysia-issued debit cards, you may need to reach out to your bank to activate your debit card for online purchases.

Bank transfers

Please reach out to us at [email protected] if you would like to make payment via bank transfer.

YYC Group has branches located across Kuala Lumpur, Selangor, Penang, Johor and Singapore!

You might be missing valuable opportunities to save money on your taxes! Relying solely on your tax agent can sometimes lead to over-declarations as they may aim to avoid potential tax penalties. To ensure you're not leaving money on the table, it’s crucial to understand the latest tax regulations. Our platform offers insights that can help you optimize your tax strategy and avoid unnecessary costs

Generally, any activity relevant to your job that increases your knowledge, skills and ability to perform your job can be included as CPD. Such activity may include online learning on platforms like YYC taxPOD. You’ll need to check with your relevant professional body for the CPD guidelines applicable to you.

Certificates for course completion are available for download within the platform.

Currently, questions cannot be asked within our platform, but all of our tax-related webinars that you will have access to throughout your subscription period include live Q&A sessions, where our tax professionals can answer your questions on-the-spot.

Your annual subscription for YYC taxPOD will start when payment is made and will continue for a period of one year. Annual subscriptions purchased are billed annually at the beginning of the subscription.

All payments made on our platform are non-refundable.

YYC is an Asian-grown accounting and advisory firm. Established in 1974, YYC Group has more than 47 years of experience in helping clients take their businesses to newer heights.

Backed by our commitment to empower entrepreneurial success, YYC Group has served 20,000 clients across Malaysia and Singapore. Through our YYC Business School, we have also trained more than 130,000 participants with more than 5,000 workshops conducted to date.