How to Submit Consolidated e-Invoice via MyInvois Portal in Malaysia [Update 2025]

What Is a Consolidated e-invoice?

To assist the Suppliers in complying with e-Invoice requirements and to reduce the burden on both Suppliers and Buyers, the Inland Revenue Board (IRB) allows the Suppliers to consolidate the transactions with Buyers (who do not require an e-Invoice) into a consolidated e-Invoice on a monthly basis.

Suppliers will be allowed to aggregate transactions with Buyers who do not require an e-Invoice on a monthly basis and submit a consolidated e-Invoice to IRB within seven (7) calendar days after the month-end.

While the MyInvois portal is now officially live, it is recommended that taxpayers first test issuing e-Invoice in the testing environment before proceeding with the live issuance. This will allow you to confidently test the system without the risk of errors affecting real e-Invoices! The sandbox testing environment (for those who are not required to implement e-invoicing yet ) is accessible at preprod-mytax.hasil.gov.my, a simulated platform provided by the IRB/LHDN.

Malaysia Industries are not allowed from Using Consolidated e-Invoice

Certain industries are not allowed to use consolidated e-Invoices due to the nature of their transactions. These industries include:

- Automotive Industry: Sales of motor vehicles.

- Aviation Industry: Sales of flight tickets and private charters.

- Luxury Goods and Jewelry: Specific details to be clarified.

- Construction Industry: Contractors involved in construction projects.

- Wholesale/Retail of Construction Materials: Sales of construction materials, regardless of volume.

- Licensed Betting and Gaming: Payouts to winners for betting and gaming activities.

- Payment to agents/ dealers/ distributors: Payments made to agents, dealers or distributors.

Businesses in these industries must issue individual e-Invoices for each transaction, as consolidated e-Invoices are not permitted.

Want to know how to issue a consolidated e-Invoice? Here’s a step-by-step guide.

Step-By-Step Guide for Consolidated e-Invoice Submission via MyInvois Portal

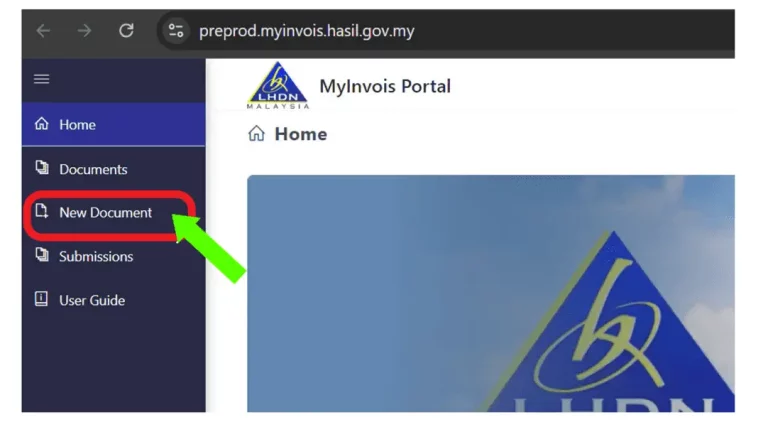

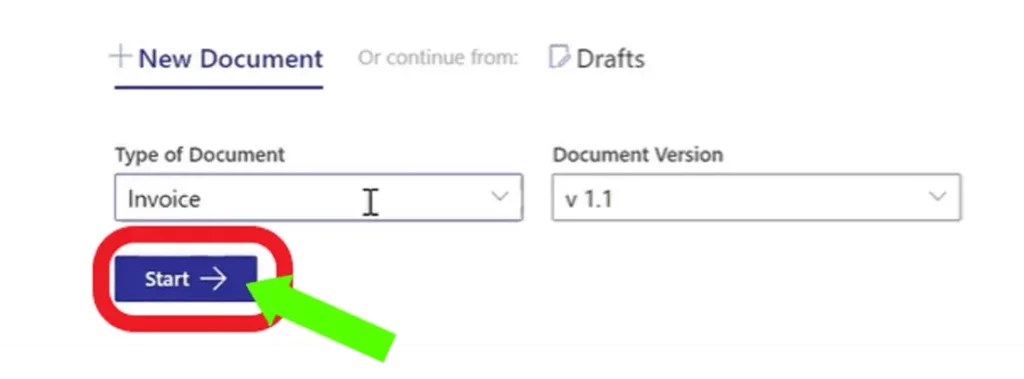

Step 1: New Document

- Click on the New Document button on the side navigation bar.

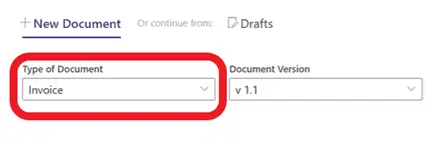

- Select Invoice for the type of document.

- The submission of consolidated e-invoice is not applicable for self-billed e-invoice, except for the following self-billed circumstances:

(a) transactions with individuals (who are not conducting a business)

(b) interest payment to public at large (regardless businesses or individuals)

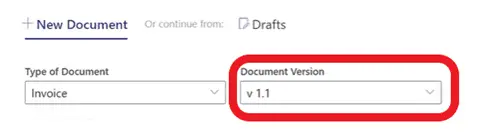

(c) claim, compensation or benefit payments from the insurance business of an insurer to individuals (who are not conducting a business) - Select v1.1 for document version.

- Click on Start.

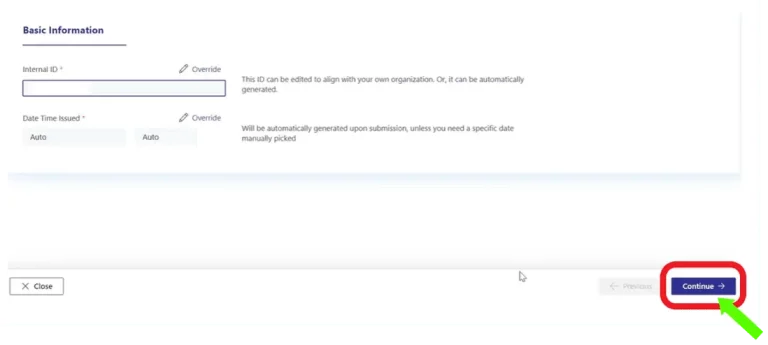

Step 2: Add Basic Information

- The invoice number, date and time are automatically generated by the system.

- Click on Continue.

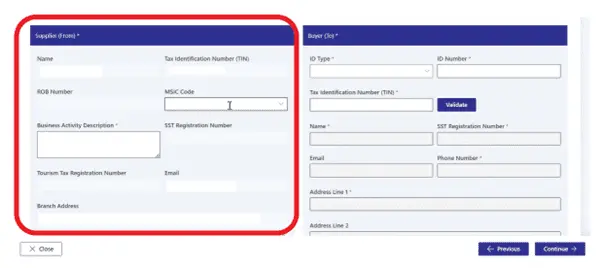

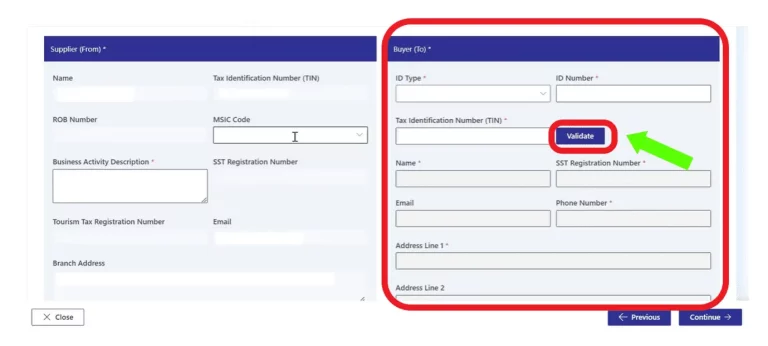

Step 3: Add Buyer and Supplier details

- In the supplier section, users are only required to select an MSIC code and provide a description of their business activity. The other fields are automatically filled in.

- In the Buyer section, users are required to select an ID type, enter an ID number and TIN. Then click on Validate.

- Once it is validated, fill in the remaining fields.

- Click Continue once all the details for buyer and supplier have been filled in.

Step 4: Line Items

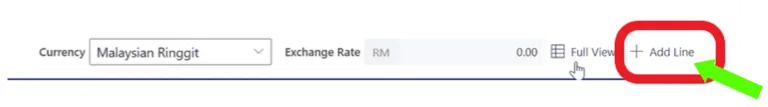

- Choose Currency.

- Click Continue.

- Click Add Line.

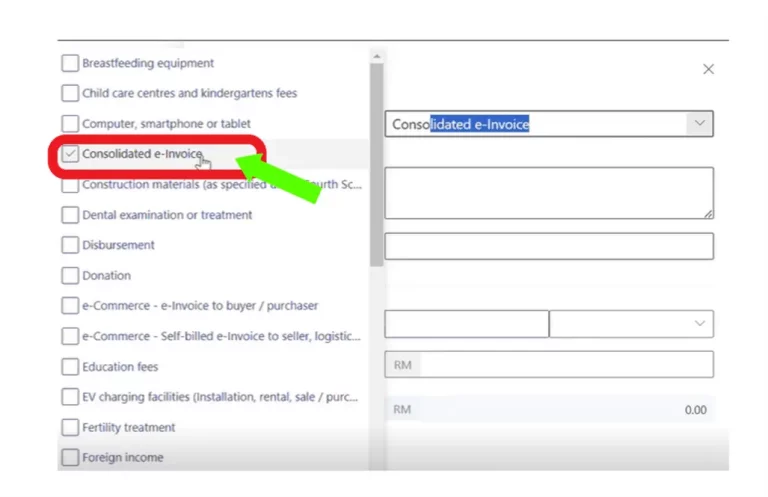

- Select Consolidated e-Invoice for classification code.

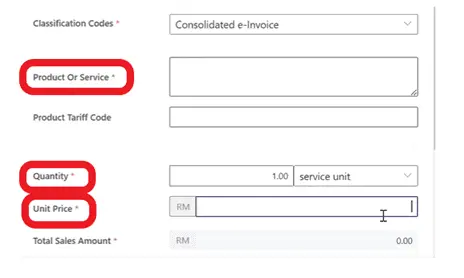

- Enter the details for the Product Or Service, Quantity, and Unit Price.

- Then the Total Sales Amount will be generated automatically.

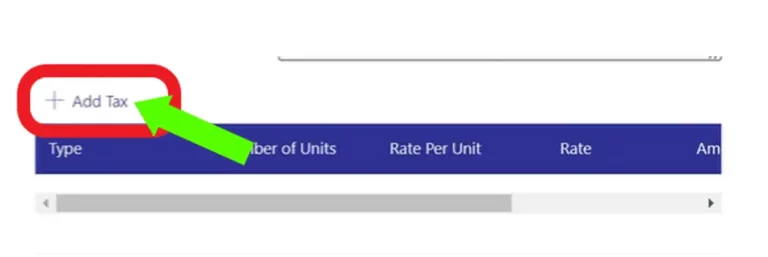

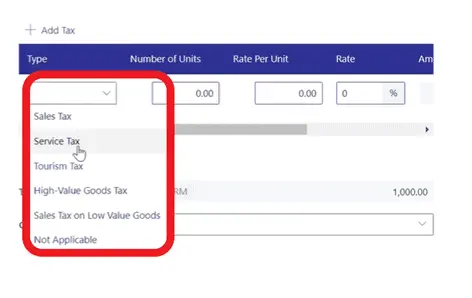

- Scroll down and Click on Add Tax.

- Select your Tax Type.

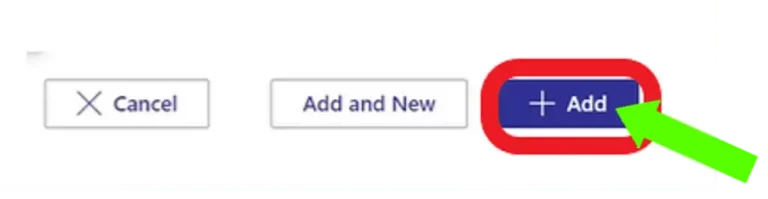

- After filling in all the details, click on Add.

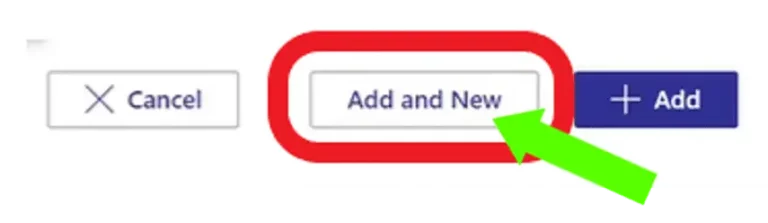

- To add another item, click on Add and New.

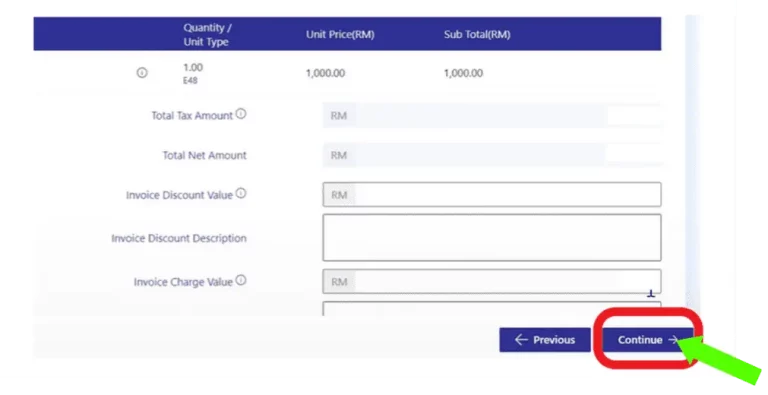

- Click on Continue once all the details have been filled in.

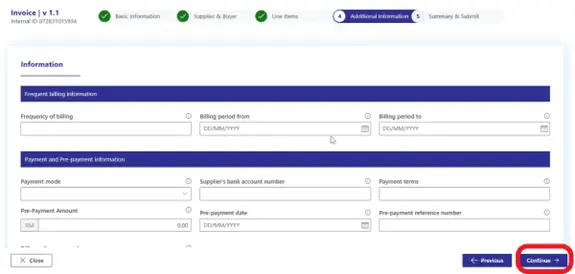

Step 5: Add additional information

- Review the optional fields (frequent billing information, payment and pre-payment information, shipping information) and click Continue.

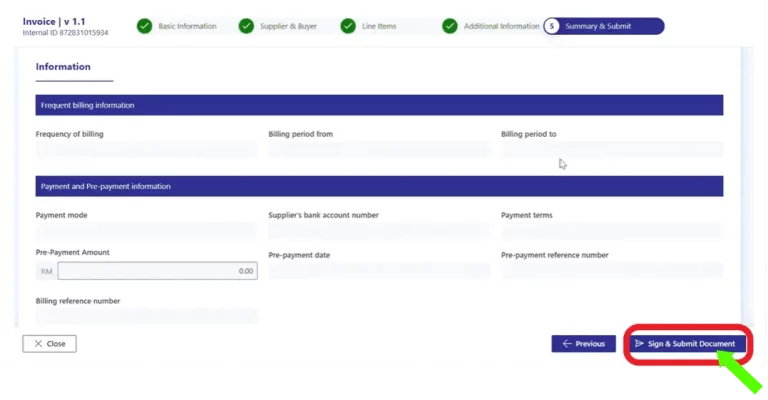

Step 6: Review and Finalize

- Review the details on the summary page.

- Once confirmed, click Sign and Submit Document.

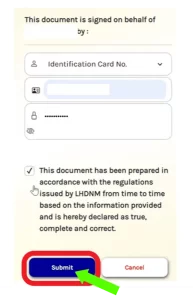

Step 7: Document Signing

- Choose your ID Type to sign the document.

- Enter User ID and type in your Password.

- Click Submit.

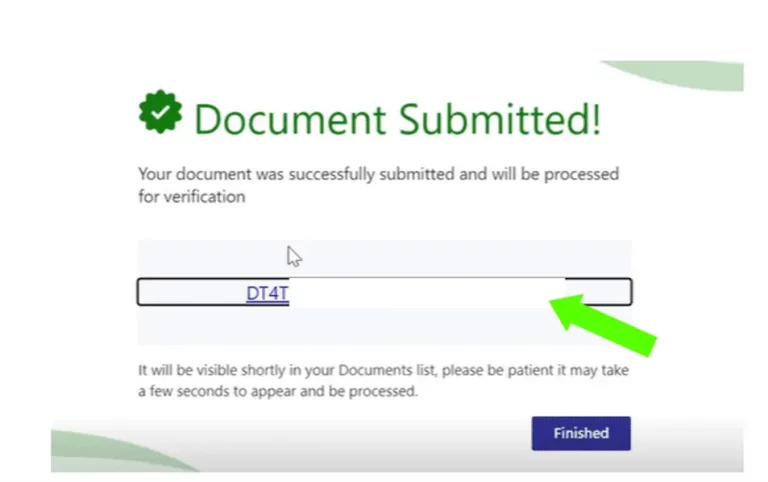

- A pop-up will appear and there will be a link.

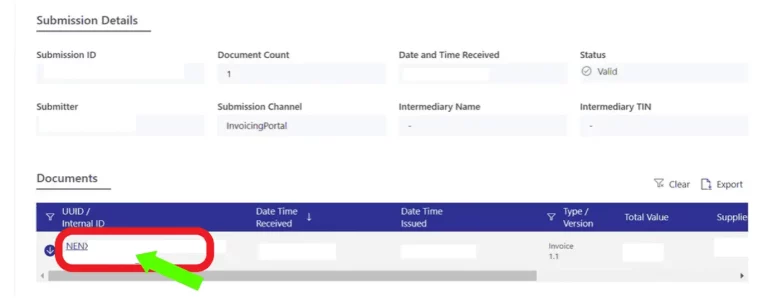

- Click on the link and you will be directed to a page where you will see the submission details.

- Click on the Internal ID.

- You will be directed to the Submission Details page.

- Click on the UUID/ Internal ID and you will be directed to your e-invoice.

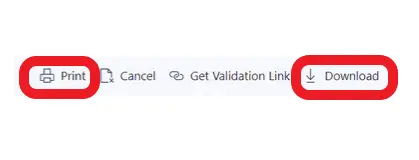

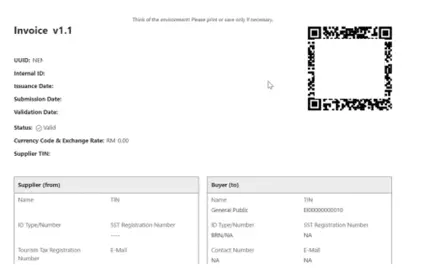

- You can print or download your e-Invoice here.

- Click on Print to view your e-Invoice as shown below.

Formatting the Consolidated e-Invoice

When preparing a consolidated e-Invoice, businesses can choose one of the following methods:

Option 1: One Receipt Number Per Line

- Each receipt is listed individually on a separate line.

- Example: Receipt numbers 12345, 12346, and 12348 are listed as three separate entries.

Option 2: Grouping Sequential Receipt Numbers

- Sequential receipt numbers are grouped together on a single line.

- If a sequence is interrupted by a customer requesting an individual e-Invoice, the grouping continues with the next set of receipts.

- Example: Receipt numbers 1110-1112, followed by 1114-2450, then 2452-3107.

Key Considerations for Businesses Malaysia

1. Exclusions

- Customers who requested and received individual e-Invoice should not be included in the consolidated e-Invoice.

2. Validated e-Invoice

- Once the consolidated e-Invoice is validated by LHDN, there is no requirement to share it with the customers.

3. Flexibility During Transition

- During the initial implementation phase, businesses may have some flexibility to familiarize themselves with the system. This includes allowances for minor adjustments in the reporting process.

Learn e-invoicing with YYC taxPOD: The Ultimate e-invoicing Course Malaysia

Malaysia Comprehensive e-invoicing Learning Course Modules

Are you ready to streamline your invoicing processes and ensure compliance with Malaysia’s Inland Revenue Board (LHDN) regulations? The YYC taxPOD e-invoicing Learning Course is the perfect solution for businesses seeking to master the e-invoicing system efficiently and effectively.

Why Choose the YYC e-invoicing Course?

- Comprehensive e-invoicing Learning Modules: Gain a deep understanding of e-invoicing fundamentals, including consolidated e-invoicing, self-billed e-invoices, and transaction workflows.

- Expert Guidance: Learn directly from Malaysia’s leading tax professionals, ensuring your knowledge is practical, accurate, and industry-specific.

- Real-World Applications: Discover how to apply e-invoicing strategies tailored to your business, including API integration with accounting systems.

- Stay Updated: Access monthly updates and live webinars to ensure you’re always informed about the latest e-invoicing regulations.

Who Should Take This e-invoicing Course?

- Business owners preparing to implement e-invoicing Malaysia.

- Finance and accounting professionals looking to simplify compliance.

- Teams aiming to optimize invoicing systems while staying up-to-date with LHDN requirements.

Enroll in the YYC taxPOD e-invoicing Course today and unlock the knowledge and tools you need to navigate Malaysia’s e-invoicing landscape with confidence.

Why Consolidated e-Invoice Matter in Malaysia

The consolidated e-Invoice system reduces the administrative burden for businesses that cater to a high volume of customers who do not require e-Invoice. By allowing receipts to be grouped, businesses can streamline compliance efforts while maintaining a focus on their day-to-day operations.

If you found this article helpful, share this valuable information with your friends and family, that will be helpful to them too!

e-invoicing is becoming a mandatory requirement for all businesses in Malaysia. Full implementation is scheduled for July 2025, with larger businesses adopting it starting from August 2024. It’s crucial for all business owners to stay informed about e-invoicing updates, as larger businesses may require their suppliers who have yet to implement e-invoicing to do so at an earlier date

You can always learn more via the YYC taxPOD platform!

YYC taxPOD is Malaysia’s first all-in-one tax e-learning platform, offering the expertise of a team of professionals at your fingertips. YYC taxPOD offers comprehensive tax education and regular updates on the latest tax laws and regulations.

Visit YYC taxPOD now and sign up for a taxPOD demo!