What are the 5 Types of e-invoice in Malaysia [Latest Update 2025]

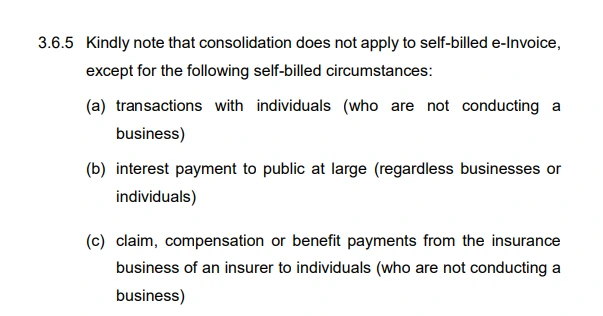

1. e-Invoice

An e-Invoice is the digital equivalent of a traditional paper invoice. It is an electronic document that outlines the details of a transaction between a buyer and a seller. The primary difference between an e-Invoice and a physical invoice is the format. Key features of an e-Invoice typically include:

- Structured data: Information is organized in a specific format, making it machine-readable.

- Digital format: Typically in XML or JSON format, as mandated by the Inland Revenue Board (IRB).

- Mandatory fields: As per the latest guideline, an e-Invoice has a total of 55 fields, covering various details such as the supplier’s information, buyer’s information, products or services details, tax details, payment details, etc.

- Near real-time validation: e-Invoices will be validated by the IRB and a validation link will be assigned to the validated e-Invoice.

- Unique identification: A unique identifier number will be assigned by the IRB.

- Security: Encrypted to protect sensitive information.

(A sample visual representation of an e-Invoice)

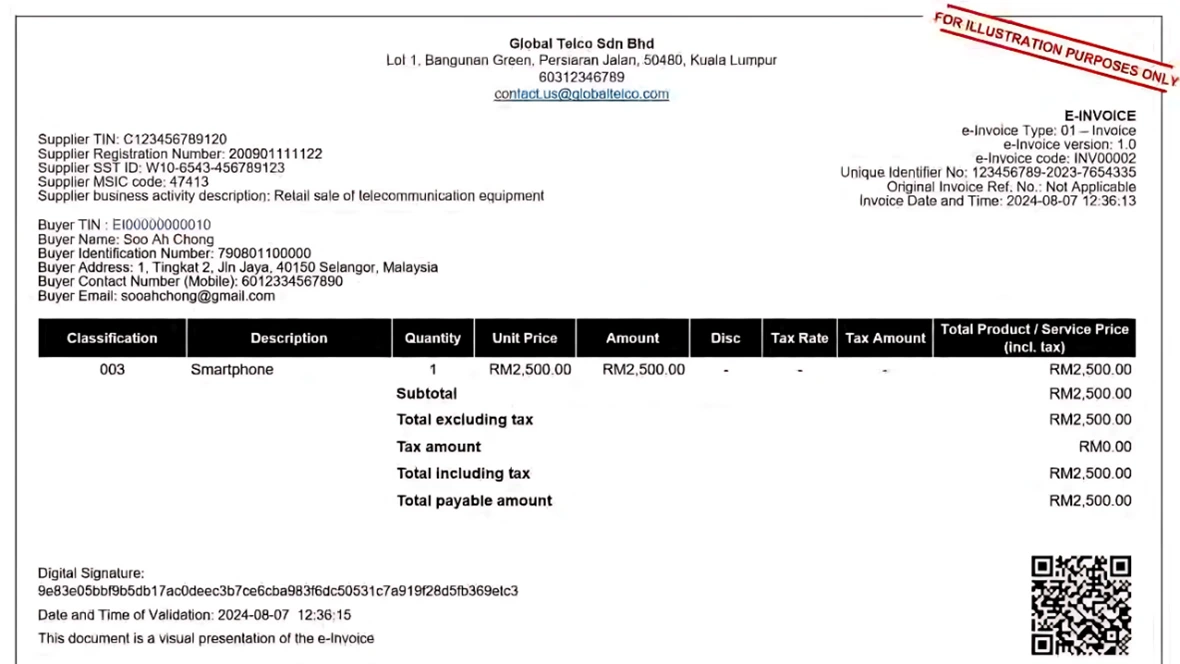

2. Consolidated e-Invoice

A consolidated e-Invoice is a single electronic document that combines multiple individual receipts, invoices, or transactions into one. This is typically used when a business has issued multiple invoices to a customer within a specific period (e.g., monthly) and the customer does not require an e-Invoice. It eliminates the need for issuing separate e-Invoices for each transaction.

Consolidated e-Invoices typically apply to certain business-to-consumer (B2C) transactions. In cases where buyers do not require an e-Invoice, suppliers may issue a receipt or invoice to the buyers in line with current business practices. Subsequently, suppliers are required to aggregate these receipts or invoices and issue a consolidated e-Invoice as proof of income. Additionally, the IRB has set a specified timeframe for the submission of consolidated e-Invoices. According to the IRB’s guidelines, suppliers must submit consolidated e-Invoices to IRB within 7 calendar days after the month-end.

Additionally, as of July 26, 2024, the IRB has granted a 6-month relaxation period for the mandatory implementation of e-invoicing Malaysia. During this time, businesses can issue consolidated e-Invoices for all transactions (including certain industries prohibited from issuing consolidated e-Invoice) instead of individual e-Invoices, giving businesses more time to adjust to the new system and implement necessary changes.

(A sample visual representation of a consolidated e-Invoice)

Industries Prohibited from Issuing Consolidated e-Invoices:

According to the IRB’s guidelines, certain industries are prohibited from issuing consolidated e-Invoices. This implies that these industries must issue individual e-Invoices for each transaction. These industries include:

- Automotive

- Aviation

- Luxury goods and jewelry

- Construction

- Wholesalers and retailers of construction materials

- Licensed betting and gaming

- Payments to agents/dealers/distributors

Learn more on Consolidated e-Invoice Submission via MyInvois Portal.

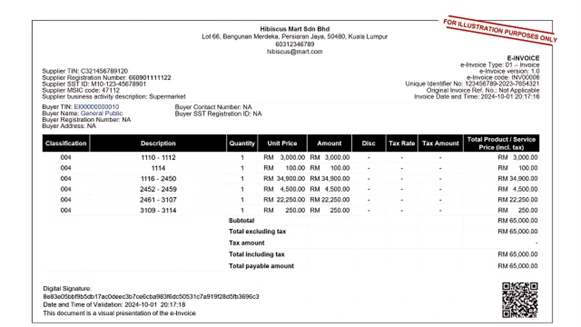

3. Self-billed e-Invoice

A self-billed e-Invoice is an electronic document created and issued by the buyer instead of the seller. This typically occurs under specific circumstances outlined by the IRB. Scenarios where self-billed e-Invoices are applicable include:

- Payments to agents, dealers, or distributors

- Goods sold or services rendered by foreign suppliers

- Profit distribution (e.g., dividend distribution)

- Electronic commerce (“e-commerce”) transactions

- Payouts to all betting and gaming winners

- Acquisition of goods or services from individual taxpayers (who are not conducting a business) (applicable only if the other self-billed circumstances are not applicable)

- Interest payments, except:

- Businesses (e.g., financial institutions, etc.) that charge interest to the public at large (regardless of whether they are businesses or individuals)

- Interest payment made by an employee to an employer

- Interest payment made by a foreign payor to Malaysian taxpayers

- Claim, compensation, or benefit payments from the insurance business of an insurer

Essentially, a self-billed e-Invoice is a deviation from the standard invoicing process, where the buyer assumes the role of the invoice issuer under specific circumstances.

(A sample visual representation of a self-billed e-Invoice)

4. Credit Note / Debit Note / Refund Note

- Credit Note: A credit note is a document issued by a seller to a buyer to reduce the amount owed. This is typically done due to returned goods, pricing errors, or other discrepancies on a previous invoice. This can happen if:

- The buyer returns some items.

- There was a mistake in the price.

- The items were damaged or incorrect.

The credit note will list the original invoice’s details, explain why the credit is being given, and show the amount of money being reduced. It helps both the seller and buyer keep their financial records accurate.

- Debit Note: A debit note is issued to indicate additional charges on a previously issued e-Invoice. It’s essentially the opposite of a credit note. This can happen if:

- The buyer received extra items.

- Incorrect quantities.

- Price undercharged.

Debit notes include details such as the original invoice number, the reason for the debit, and the amount to be adjusted. The debit note serves as a formal document for a debit adjustment to the buyer’s account.

- Refund Note: A refund note is a document issued by a seller when there is a return of money to the buyer. This document confirms that the buyer will receive money back, often due to returned goods or cancelled services. This can happen if:

- The buyer returned goods because they were defective, damaged, or not as described.

- The order was cancelled before it was fulfilled.

- A service was not provided as expected.

Refund notes include details such as the original invoice number, the reason for the refund, and the amount to be refunded.

If an e-Invoice contains errors, the buyer may request rejection and the supplier can cancel the e-Invoice within 72 hours from the time of validation via the MyInvois Portal. If the e-Invoice is not rejected or cancelled within 72 hours, no cancellation would be allowed. Any subsequent adjustments would have to be made by issuing a new e-Invoice (e.g., credit note, debit note, or refund note e-Invoice).

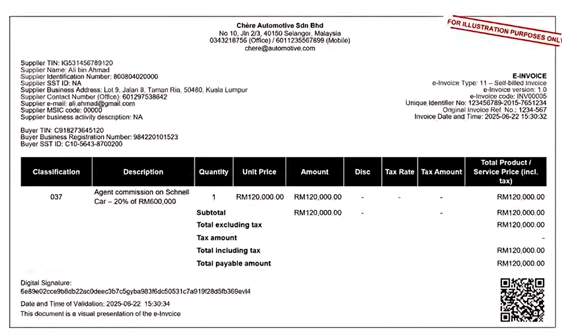

5. Consolidated Self-Billed e-Invoice

A Consolidated Self-Billed e-Invoice is a single document that combines multiple self-billed e-Invoices into one for simplified management and reporting. This type of e-invoice is particularly useful in situations where buyers are responsible for issuing self-billed e-Invoices to themselves for various transactions but prefer to consolidate these transactions into one document at the end of the month.

This approach is often employed to streamline processes, especially in high-volume transactions involving specific circumstances as below:

The consolidated self-billed e-Invoice must be submitted and validated through the MyInvois Portal within 7 calendar days after the month-end to comply with regulatory requirements.

Key Features:

- Combination of Multiple Transactions : Aggregates multiple transactions for easier tracking.

- Streamlined Validation: Reduces the burden of validating each individual self-billed e-invoice separately.

- Compliance Requirement: Must be submitted to the MyInvois Portal within the stipulated 7 calendar days time frame after the month-end.

Examples:

Insurance Payouts to Individual Policyholders:

An insurer pays out multiple claims to individual policyholders (who are not conducting business) over the course of the month. These payouts are consolidated into one e-Invoice for validation at the end of the month.

Consolidated Self-Billed E-Invoice: Fields to be filled out

|

Data Field |

Details |

|

Supplier’s Name |

General Public |

|

Supplier’s TIN |

EI00000000010 |

|

Supplier’s Registration/IC |

NA |

|

Supplier’s Contact Number |

NA |

|

Supplier’s SST No. |

NA |

|

Supplier’s MSIC |

00000 |

|

Supplier’s Business Activity Description |

NA |

|

Classification |

004 |

|

Description of Product or Service |

Summary or list of receipt numbers |

Consolidated Self-Billed e-Invoice During the 6-month Relaxation Period

The Consolidated Self-Billed E-Invoice was given flexibility as part of the 6-month relaxation period announced by LHDN (Inland Revenue Board of Malaysia) on 30th July 2024. During this period, businesses are allowed to consolidate multiple transactions into a single consolidated self-billed e-Invoice to simplify compliance with the new e-invoicing system.

Timeline:

- Introduction Date: 30th July 2024

- End Date:

- Phase 1: 31st January 2025 (end of the 6-month relaxation period)

- Phase 2: 30th June 2025

- Phase 3: 31st December 2025

After the 6 Months Relaxation Period:

For Phase 1 taxpayers, from 1st February 2025 onwards, businesses will be required to issue individual self-billed e-invoices for each transaction instead of consolidating them, except in the specific cases allowed under the guidelines (e.g., transactions with individuals who are not conducting a business).

What are the Differences Between Consolidated e-Invoice & Consolidated Self-Billed e-Invoice

The primary difference between Consolidated e-Invoices and Consolidated Self-Billed e-Invoices lies in who issues the invoices and the purpose for which they are used:

Consolidated e-Invoice

- Who Issues It:

Issued by the supplier (seller) to consolidate multiple receipts or invoices into one document. - Purpose:

Usually used for business-to-consumer (B2C) transactions where the buyer does not require individual e-invoices. Consolidated e-Invoices combine multiple transactions into a single invoice (e.g., for monthly reporting). - Example:

A retail store issuing multiple receipts to customers and later consolidating these into one e-Invoice for IRBM validation. - Key Feature:

Combines receipts/invoices from multiple transactions where individual e-invoices are not required by the buyer.

Consolidated Self-Billed e-Invoice

- Who Issues It:

Issued by the buyer, not the seller, consolidating multiple transactions into one document. - Purpose:

Used for transactions where the buyer is responsible for issuing invoices on behalf of the supplier. Commonly employed in cases with high transaction volumes, such as interest paid to the public at large. - Example:

An insurer pays out multiple claims to individual policyholders (who are not conducting business) over the course of the month - Key Feature:

Combines multiple transactions under specific circumstances (where the buyer assumes the invoicing role).

Key Distinction:

| Feature | Consolidated e-Invoice | Consolidated Self-Billed e-Invoice |

| Issuer | Supplier | Buyer |

| Applicable To | Transaction where buyer does not require an e-Invoice | Specific self-billed scenarios |

| Purpose | Consolidate multiple sales | Consolidate multiple self-billed transactions |

| Usage Example | Retail store receipts | Interest payment to public at large |

| Who Takes Invoicing Role | Seller | Buyer |

Both are useful for streamlining high-volume transactions but differ in their applicability and issuance responsibilities.

Usage Guidelines for Different Types of e-Invoice Malaysia

|

Type of e-Invoice |

When to Use |

|

e-Invoice |

For transactions between a buyer and a seller where all details (buyer, seller, goods/services, tax, payment) need to be electronically validated in near real-time. Mandatory for compliance with IRB guidelines. |

|

Consolidated e-Invoice |

For consolidating multiple transactions or invoices (e.g., monthly) into one document, mainly for business-to-consumer (B2C) transactions where the buyer does not require individual e-invoices. |

|

Self-Billed e-Invoice |

When the buyer is responsible for issuing invoices instead of the seller, under specific conditions like payments to agents, foreign suppliers, or profit distribution. |

|

Credit Note / Debit Note / Refund Note |

When there are adjustments to existing invoices due to returns, pricing errors, or cancelled services. Used to issue corrections or confirm refunds. |

|

Consolidated Self-Billed e-Invoice |

Used for specific self-billed circumstances for consolidating multiple transactions into one document for streamlined reporting. |

Learn e-invoicing with YYC taxPOD: The Ultimate e-invoicing Course in Malaysia

Malaysia Comprehensive e-invoicing Learning Course Modules

Are you ready to streamline your invoicing processes and ensure compliance with Malaysia’s Inland Revenue Board (LHDN) regulations? The YYC taxPOD e-invoicing Learning Course is the perfect solution for businesses seeking to master the e-invoicing system efficiently and effectively.

Why Choose the YYC e-invoicing Course?

- Comprehensive e-invoicing Learning Modules: Gain a deep understanding of e-invoicing fundamentals, including consolidated e-invoicing, self-billed e-invoices, and transaction workflows.

- Expert Guidance: Learn directly from Malaysia’s leading tax professionals, ensuring your knowledge is practical, accurate, and industry-specific.

- Real-World Applications: Discover how to apply e-invoicing strategies tailored to your business, including API integration with accounting systems.

- Stay Updated: Access monthly updates and live webinars to ensure you’re always informed about the latest e-invoicing regulations.

Who Should Take This e-invoicing Course?

- Business owners preparing to implement e-invoicing Malaysia.

- Finance and accounting professionals looking to simplify compliance.

- Teams aiming to optimize invoicing systems while staying up-to-date with LHDN requirements.

Enroll in the YYC taxPOD e-invoicing Course today and unlock the knowledge and tools you need to navigate Malaysia’s e-invoicing landscape with confidence.

You can always learn more via the taxPOD platform!

YYC taxPOD is Malaysia’s first all-in-one tax e-learning platform, offering the expertise of a team of professionals at your fingertips. YYC taxPOD offers comprehensive tax education and regular updates on the latest tax laws and regulations.

Visit YYC taxPOD now and sign up for a taxPOD demo!