Comprehensive Guide to 2025 Personal Tax Relief in Malaysia : Maximise Your Income Tax Savings

As the new assessment year approaches, understanding the personal tax relief measures for the year of assessment 2025 in Malaysia can help individuals significantly reduce their taxable income and maximise income tax savings.

The personal tax relief available will alleviate financial burdens and supporting personal growth. This guide provides a detailed breakdown of the individual tax deductions available for year of assessment 2025.

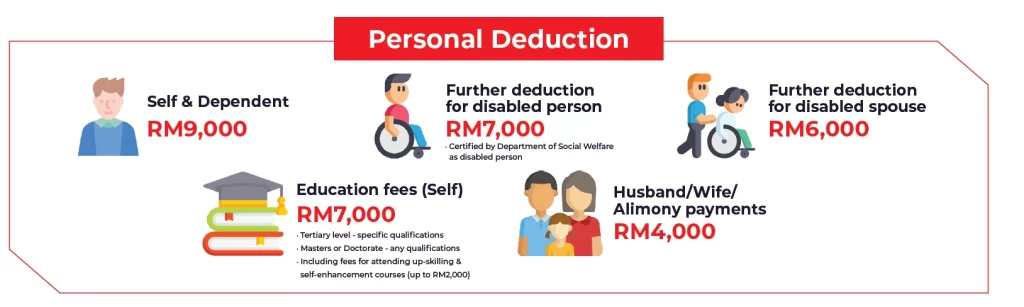

1. Personal Tax Relief 2025 – Self & Dependent

- Relief Amount: RM9,000

- Details:

- This personal tax relief is automatically granted for an individual and their dependent relatives.

2. Personal Tax Relief in YA 2025 – Disabled Persons

- Relief Amount: RM7,000

- Details:

- Taxpayers certified as disabled by the Department of Social Welfare (DSW) are eligible for this tax relief in 2025.

- The certification must be in writing to qualify for this income tax relief.

3. Personal Tax Relief in YA 2025 – Disabled Spouse

- Relief Amount: RM6,000

- Details:

- Taxpayers with a disabled spouse are eligible to claim this personal tax relief in malaysia.

- Conditions for Eligibility:

- The disabled spouse must reside with the taxpayer.

- The disabled spouse must either have no total income or choose joint assessment with the taxpayer.

4. Personal Tax Relief in YA 2025 – Spouse or Alimony Payments to Former Wife

- Relief Amount: RM4,000

- Details:

- This tax relief Malaysia applies to both spouses or alimony payments to former wife as follows:-

- Relief for Husband:

- A deduction of RM4,000 is granted to the wife if the husband has no income or elects for joint assessment in the wife’s name.

- Ineligible if the husband earns gross income exceeding RM4,000 from sources outside Malaysia.

- Relief for Wife:

- A deduction of RM4,000 is granted to the husband if the wife has no income or elects for joint assessment in the husband’s name.

- Ineligible if the wife earns gross income exceeding RM4,000 from sources outside Malaysia.

- Relief for Alimony Payments to Former Wife:

- A deduction of up to RM4,000 or the actual amount paid (whichever is lower) is allowed for payments made to a former wife.

- Restrictions:

- Total deduction for a current wife and alimony to a former wife is limited to RM4,000.

- Voluntary alimony payments without a formal agreement do not qualify for personal tax relief.

- Relief for Husband:

- This tax relief Malaysia applies to both spouses or alimony payments to former wife as follows:-

5. Personal Tax Relief 2025 – Education Fees

- Relief Amount: Up to RM7,000

- Details:

- This income tax relief applies to educational and skill-enhancement expenses. The relief is divided into three categories:

- Courses Other Than Masters/Doctorate Degrees:

- Covers fields such as law, accounting, Islamic finance, technical, vocational, industrial, scientific, or technological studies.

- Must be undertaken in institutions or professional bodies recognised by the Malaysian Government or approved by the Minister of Finance.

- Courses at Masters or Doctorate Levels:

- Any course of study undertaken to acquire any skill or qualification in recognised institutions.

- Courses for Up-skilling or Self-enhancement:

- Taxpayers can claim up to RM2,000 for skill-enhancement courses under the National Skills Development Act 2006 (Act 652).

- This RM2,000 forms part of the RM7,000 total deduction limit.

- Courses Other Than Masters/Doctorate Degrees:

- Important Notes:

- The full list of recognised institutions can be accessed via the official portal of the Ministry of Higher Education Malaysia.

- This income tax relief applies to educational and skill-enhancement expenses. The relief is divided into three categories:

Why Maximise Your 2025 Personal Tax Relief?

Understanding personal deductions and other income tax relief measures allows you to fully leverage the tax benefits available in Malaysia. Taxpayers can significantly reduce their taxable income by claiming tax reliefs such as education fees and husband / wife tax relief. With proper planning, you can optimise your tax savings by maximising these deductions.

Take Action: Claim Your Personal Tax Relief for YA 2025

Don’t miss out on valuable individual tax deductions for tax relief in 2025. Whether you are claiming the basic personal tax relief for yourself and dependents, or other tax reliefs such as education fees or spousal support, every deduction helps to reduce your tax liability.

Consult a professional tax advisor or visit the official Malaysian Inland Revenue Board (LHDN) portal for guidance on submission of tax return. Plan ahead and keep all necessary documentation to ensure a seamless tax filing process.

By staying informed about personal tax relief in Malaysia, you can optimise your savings while complying with individual tax regulations. Take full advantage of these reliefs and maximise your tax savings for 2025!

How YYC taxPOD Can Help Businesses in Malaysia

YYC taxPOD is an online Malaysia tax learning platform offering comprehensive tax knowledge to businesses in Malaysia. It provides unlimited access to a wealth of tax-saving knowledge through masterclass videos, live update classes, and webinars.

Key Features of YYC taxPOD

- Masterclass Videos: Cover essential tax knowledge with downloadable course materials and case studies.

- Monthly Live Update Classes: Keep you informed on the latest tax updates, including income tax, SST, e-invoicing and more.

- Live Webinars: Provide in-depth knowledge on various tax topics, allowing business owners and finance teams to learn at their own pace.

Benefits of Using YYC taxPOD

- Affordable Access to Expert Knowledge: Gain insights from seasoned tax professionals without the high cost of hiring full-time experts.

- Regular Updates: Stay updated with the latest tax laws and regulations to ensure compliance and maximise tax savings.

- Convenient Learning: Access tax planning resources anytime, anywhere, making it easier to integrate tax education into your business routine.

For more information on how YYC taxPOD can assist your business, visit our official website or book a demo session.

Empowering Your Tax Planning with YYC taxPOD: Your Guide to National Budget 2025 in Malaysia

The Budget 2025 introduces significant changes to the country’s economic and tax policies, focusing on growth, sustainability, and the well-being of its citizens. A standout measure is the implementation of a dividend tax Malaysia, which imposes a 2% tax on dividend income exceeding RM100,000 annually. This marks a major shift from the previous full exemption on dividend income and is a key area of focus for taxpayers.

To help individuals and businesses adapt to these changes, YYC taxPOD, Malaysia’s premier tax e-learning platform, has created a comprehensive guide – Budget 2025 Malaysia. This guide breaks down the new tax policies and grants, equipping you with the knowledge needed to navigate the evolving tax landscape effectively.