Everything You Need to Know About Medical Expenses Tax Deduction for YA 2025 in Malaysia

Managing medical expenses can be a significant financial challenge. To support taxpayers, the Malaysian government provides comprehensive medical expenses tax deductions for various healthcare needs, including treatment for serious diseases, supporting equipment, and care for parents. This guide outlines all available tax reliefs for medical expenses and related categories for the Year of Assessment (YA) 2025 in Malaysia.

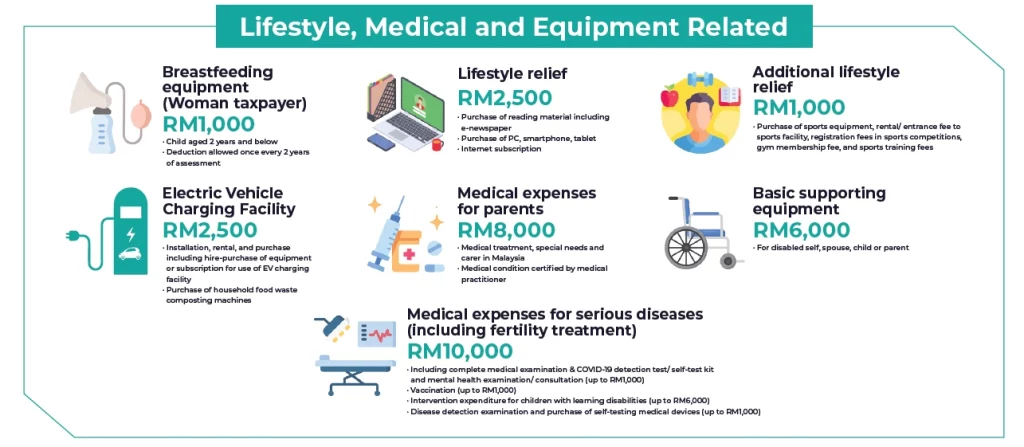

1. Medical Expenses Tax Deduction for Serious Diseases

Deduction Limit: Up to RM10,000 (for all subcategories combined).

Taxpayers facing substantial costs for treating serious diseases are eligible for medical expenses tax deductions. This category includes several subcategories that address a wide range of healthcare needs.

(a) Treatment for Serious Diseases

- Covered Conditions:

- Diseases such as AIDS, Parkinson’s disease, cancer, renal failure, and leukemia.

- Other critical illnesses like heart attacks, pulmonary hypertension, major organ transplants, and neurological deficits.

- Eligibility:

- Patients must be the taxpayer, their spouse, or their child.

- Claims must be supported by receipts and certifications from a medical practitioner registered with the Malaysian Medical Council (MMC).

(b) Fertility Treatment

- Covers treatments such as:

- Intrauterine Insemination (IUI) and In vitro fertilization (IVF).

- Consultation fees and related medications.

- Eligibility:

- Married individuals only.

- Requires receipt and certification from MMC-registered practitioners.

- Expenses incurred by a spouse can be claimed under joint assessment for tax relief.

(c) Vaccination Expenses

- Eligible Vaccines:

- Pneumococcal, HPV, Influenza, Rotavirus, Varicella, Meningococcal, TDAP combination, and COVID-19 vaccines.

- Deduction Limit: RM1,000 (part of the overall RM10,000 cap).

- Eligibility:

- Vaccination costs for the taxpayer, spouse, or child, incurred locally or overseas.

(d) Complete Medical Examination

- Includes:

- Physical examinations covering eye, ear, chest, abdomen, etc.

- X-rays, blood and urine tests, and consultations on test results.

- Expanded in YA 2025:

- To include purchase of self-testing medical devices and fees for disease detection examination

- Deduction Limit: RM1,000 (for complete medical examination, Covid-19 detection test, and mental health examination combined).

COVID-19 Detection Tests

- Covers:

- Tests conducted in hospitals or clinics.

- Self-test kits (must be evidenced by receipts).

Mental Health Consultations

- Includes consultations with:

- Psychiatrists (Mental Health Act 2001).

- Clinical psychologists (Allied Health Professions Act 2016).

- Counselors (Counselors Act 1998).

(e) Intervention for Learning Disabilities

- Covers conditions like Autism, ADHD, Down Syndrome, and specific learning disabilities.

- Deduction Limit: RM6,000.

- Eligibility:

- Diagnostic assessment by MMC-registered practitioners.

- Rehabilitation or early intervention by allied health professionals registered under the Allied Health Professions Act 2016.

2. Medical Expenses for Parents: Tax Relief in Malaysia

Deduction Limit: Up to RM8,000.

This category provides tax relief for medical expenses for parents, addressing the needs of aging parents requiring medical care or special attention.

Eligible Expenses:

- Medical Treatment Special Needs and Carer Expenses for Parents:

- Services provided by nursing homes in Malaysia.

- Dental treatments, such as tooth extraction, filling, and scaling (excluding restorative work like dentures and crowns).

- Medicines for Parents:

- Certified by MMC-registered practitioners as necessary for medical treatment.

- Complete Medical Examination for Parents:

- Expanded cover the costs of vaccinations

- Expanded to include grandparents

- With effect from YA 2025, with a deduction limit of RM1,000.

Key Conditions:

- Parents must be natural or foster parents residing in Malaysia.

- Claims must be supported by receipts and certification from MMC-registered practitioners.

3. Basic Supporting Equipment for Disabled Individuals

Deduction Limit: Up to RM6,000.

Taxpayers can claim medical expenses tax deductions for purchasing medical supporting equipment for disabled individuals.

Eligible Equipment:

- Includes items like:

- Wheelchairs, hearing aids, artificial limbs, and hemodialysis machines.

- Exclusions:

- Spectacles and optical lenses are not covered.

Eligibility:

- The disabled individual (self, spouse, child, or parent) must be registered with the Department of Social Welfare (DSW).

4. Tax Relief for Medical Equipment and Special Needs

Comprehensive List of Medical Equipment:

Taxpayers incurring expenses for specialised medical equipment to support chronic illnesses, mobility limitations, or other medical needs can claim deductions. Eligible equipment includes the following examples:

- Portable automatic blood pressure monitor.

- Silicone ryles tube.

- Commode chair.

- Detachable armrest wheelchair (for easier transfers).

- Standard wheelchair.

- Walking frame.

- Quadripod.

- Rollator with 2 wheels and brakes.

- Roller with elbow support.

- Automatic adjustable bed.

- Ripple mattress.

- J-cushion (for pressure relief while sitting).

- Transfer board.

- Acapella (lung physiotherapy device).

- Long-term oxygen therapy equipment.

- Portable suction machine.

- Food thickener (for swallowing difficulties).

- Clean intermittent catheterization tools.

- Moist dressings (e.g., hydrocolloid dressings).

- Glucometer.

- Diapers.

- Urinary condom and bag.

- Bedpan.

- Nebulizer.

- Inhalers.

- Insulin pen.

- Urinary catheters.

- … and more

These items cater to medical treatment, special needs and carer expenses for parents.

However, the list is not exhaustive and may include other equipment as determined by medical practitioners registered with the MMC.

Important Notes for Medical Expenses Tax Deduction for YA 2025 in Malaysia

- Documentation Requirements:

- All claims must be evidenced by original receipts and certifications from MMC-registered practitioners or allied professionals.

- Expenses Must Be Incurred by the Taxpayer:

- Only expenses paid by the taxpayer qualify for medical expenses tax deductions.

- Retention for Inspection:

- Taxpayers must retain documentation for review by the Inland Revenue Board (IRB).

Conclusion: Maximise Your Medical Expenses Tax Deduction in Malaysia

The medical expenses tax deduction for YA 2025 in Malaysia provides essential financial relief for individuals and families facing significant medical costs. By understanding the categories, eligibility, and required documentation, taxpayers can effectively optimise their tax savings. For further assistance, consult a tax advisor or refer to the latest regulations on medical expenses tax deduction to ensure compliance and maximise your benefits.

How YYC taxPOD Can Help Businesses in Malaysia

YYC taxPOD is an online Malaysia tax learning platform offering comprehensive tax knowledge to businesses in Malaysia. It provides unlimited access to a wealth of tax-saving knowledge through masterclass videos, live update classes, and webinars.

Key Features of YYC taxPOD

- Masterclass Videos: Cover essential tax knowledge with downloadable course materials and case studies.

- Monthly Live Update Classes: Keep you informed on the latest tax updates, including income tax, SST, e-invoicing and more.

- Live Webinars: Provide in-depth knowledge on various tax topics, allowing business owners and finance teams to learn at their own pace.

Benefits of Using YYC taxPOD

- Affordable Access to Expert Knowledge: Gain insights from seasoned tax professionals without the high cost of hiring full-time experts.

- Regular Updates: Stay updated with the latest tax laws and regulations to ensure compliance and maximise tax savings.

- Convenient Learning: Access tax planning resources anytime, anywhere, making it easier to integrate tax education into your business routine.

For more information on how YYC taxPOD can assist your business, visit our official website or book a demo session.

Empowering Your Tax Planning with YYC taxPOD: Your Guide to National Budget 2025 Malaysia

Budget 2025 Malaysia introduces significant changes to the country’s economic and tax policies, focusing on growth, sustainability, and the well-being of its citizens. A standout measure is the implementation of a dividend tax in Malaysia, which imposes a 2% tax on dividend income exceeding RM100,000 annually. This marks a major shift from the previous full exemption on dividend income and is a key area of focus for taxpayers.

To help individuals and businesses adapt to these changes, YYC taxPOD, Malaysia’s premier tax e-learning platform, has created a comprehensive guide – Budget 2025 Malaysia. This guide breaks down the new tax policies and grants, equipping you with the knowledge needed to navigate the evolving tax landscape effectively.