Consolidated e-Invoice Guide: Interim Relaxation Period for Malaysian Businesses [Updated in Jan 2025]

Ever notice how the Inland Revenue Board of Malaysia (IRBM) loves to drop the latest updates on a Friday night? It always means overtime for us to catch up!

Based on the media release published on 26 July 2024, the IRBM has announced flexibility for taxpayers to issue consolidated e-Invoice for six months starting from the mandatory e-Invoice implementation date (e.g. 1 August 2024). This relaxation period is intended to provide taxpayers with sufficient time to fully implement e-Invoicing.

During this period, businesses are allowed to issue consolidated e-Invoice for all transactions, including self-billed e-Invoice.

However, it’s important to note that the mandatory implementation of e-invoicing hasn’t been postponed. Instead, it is an interim relaxation period to ease the transition for taxpayers.

1. This is a temporary measure for implementation of e-invoicing in Malaysia

The e-Invoicing implementation is not delayed. The recent update simply allows businesses more flexibility in how they submit invoices. We’re now allowed to issue consolidated e-Invoice for all transactions, regardless of whether the buyer requests an e-invoice or not. While this six-month period offers some flexibility, it’s essential to remember that businesses are still required to keep a copy of the receipts issued after issuing consolidated e-Invoice which should be submitted to the IRBM within 7 calendar days after the month-end for all aggregated transactions.

2. Customer invoicing requirements

During this relaxation period, businesses don’t have to send individual e-Invoice to each customer. However, customers still need to receive a regular invoice, bill, or receipt for their purchases.

3. Issuing consolidated e-Invoice are permitted for all industries

During this period, the seven industries that are not allowed to issue consolidated e-Invoice are now permitted to do so. Furthermore, businesses are allowed to issue consolidated self-billed e-Invoice for all self-billed circumstances as outlined in the Specific Guideline, including importation of goods and services. This will help all taxpayers in every industry ease the transition to e-invoicing implementation.

4. Penalties for non-compliance

Remember, failing to adhere to the consolidated e-invoice rules can result in penalties. While there’s some flexibility, it’s important to comply with the regulations by consolidating and submitting your consolidated e-invoices to the IRBM on time.

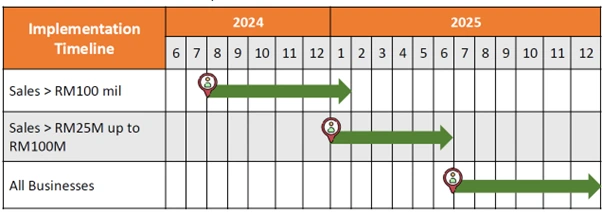

This image presents the latest 6-month relaxation period from the mandatory e-invoicing implementation date to issue consolidated e-Invoice for all transactions, categorized by business annual revenue.

Taxpayers with an annual turnover or revenue of more than RM 100 mil: August 2024 to January 2025

Taxpayers with an annual turnover or revenue of more than RM 25 mil and up to RM 100 mil: January 2025 to June 2025

All other taxpayers: July 2025 to December 2025

How to Handle Consolidated e-Invoice for Different Branches

Managing consolidated e-Invoice across multiple branches can be challenging, but it’s essential for businesses to comply with tax regulations and ensure smooth financial reporting. Here is a step-by-step guide on how to handle consolidated e-Invoice when operating multiple branches.

Scenario: Managing Multiple Branches

Imagine you are running a milk tea business with branches in the following locations:

- Pantai Remis (1 branch)

- Seremban (1 branch)

- Selangor (1 branch)

- Muar (1 branch)

For each branch, you may prepare one consolidated e-invoice per month, which must be submitted within 7 calendar days after the month-end.

Step 1: Submitting Consolidated e-Invoice

To comply with regulations, follow these guidelines:

- One Invoice per Branch:

Each branch may submit its own consolidated e-invoice. For example:- Pantai Remis: 1 consolidated e-invoice

- Seremban: 1 consolidated e-invoice

- Selangor: 1 consolidated e-invoice

- Muar: 1 consolidated e-invoice

- Deadline for Submission:

All consolidated e-Invoices must be submitted within 7 calendar days after the month ends. For instance, for transactions in August, the deadline for submission would be September 7th.

Step 2: Receipt Number Formatting

When preparing a consolidated e-invoice, you can choose one of the following methods in handling receipt numbers:

Option 1: One Receipt Number Per Line

- Each receipt number is listed on a separate line in the invoice.

- Example:

Receipt No. 12345 → Line 1

Receipt No. 12346 → Line 2

Receipt No. 12348 → Line 3

Option 2: Group Sequential Receipt Numbers in One Line

- Group a series of sequential receipt numbers into a single line.

- Example:

Receipt No. 1110 – 1112 → Line 1

Receipt No. 1114 → Line 2

Receipt No. 1116 – 1180 → Line 3

Special Case: Non-Sequential Numbers

If customers require individual e-Invoice for certain receipt numbers (e.g., 1113, 1115), there is a break of the receipt number chain, the next chain shall be included as a new line item.

Key Reminders on Issuing Consolidated e-Invoice

- Avoid Frequent Submissions:

Consolidated e-Invoice should not be submitted daily, weekly, or too frequently, as the guidelines state that it should be submitted within 7 calendar days after the month-end. - System Efficiency:

To save time and avoid manual re-entry, consider using an accounting system that integrates with the e-invoice system This approach minimizes repetitive manual work and ensures accurate reporting.

July 2024: Introduction of the Consolidated Self-Billed e-Invoice

What is Consolidated Self-Billed e-Invoice?

Self-billing refers to a situation where the buyer, rather than the seller, issues an invoice for proof of expense. Meanwhile, consolidated e-Invoice allow businesses to group multiple transactions into a single e-invoice. When a buyer issues a consolidated self-billed e-invoice, they are essentially combining the principles of self-billing with consolidation. The buyer issues a single e-invoice summarizing multiple transactions that they themselves initiated (i.e. self-billed) over a specific period, instead of generating individual self-billed e-Invoice for each transaction.

During this six-month relaxation period, businesses are allowed to issue consolidated e-Invoice, including the self-billed ones.

The timing of issuance for consolidated self-billed e-Invoice and consolidated e-Invoice is the same: they must be submitted monthly within 7 calendar days after the end of the month.

Additionally, there’s positive news! The IRBM will not undertake any legal action during this six-month relaxation period on non-compliance of the e-invoice requirements, provided that taxpayers comply with the requirement to issue consolidated e-Invoice.

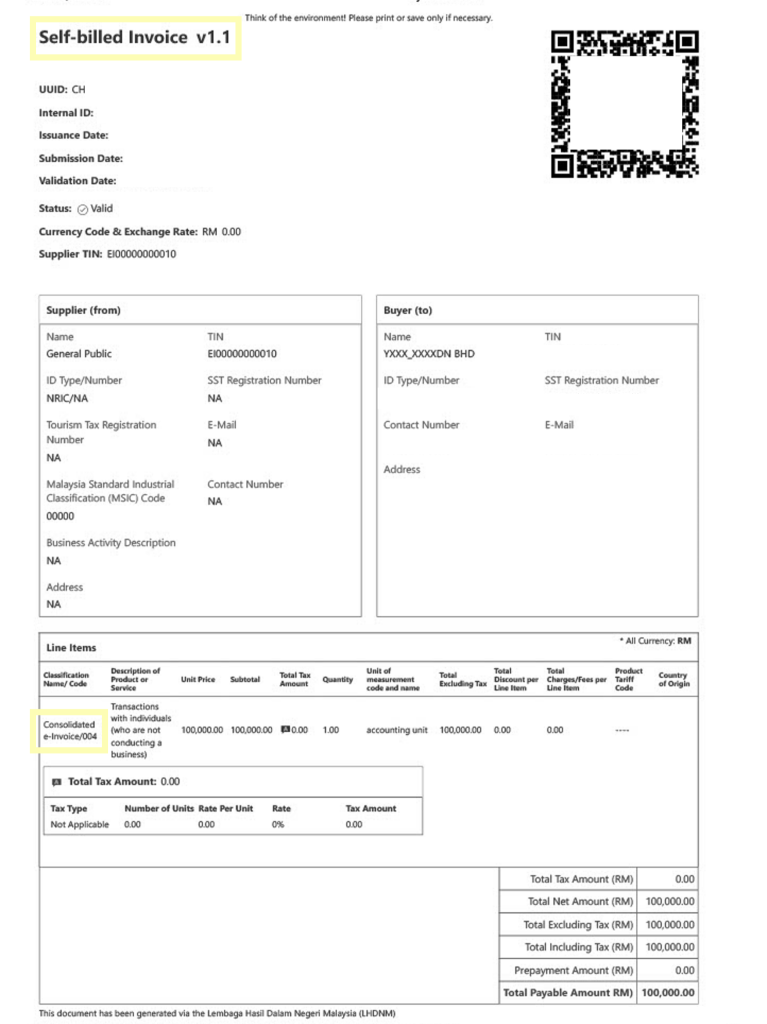

(A sample visual representation of a consolidated self-billed e-Invoice)

FAQ on Consolidated e-Invoice Malaysia

- For consolidated e-Invoice, is there a limit on the number of submissions per month? Is there a maximum amount limit? Do references need to follow a specific sequence or any serial number?

- Official guidelines state that submissions should be made within 7 calendar days after the end of each month.

- For businesses with large transaction volumes, it is possible to split submissions into multiple consolidated e-Invoices after month-end due to system upload size limits.

- Businesses with branches may prepare one consolidated e-invoice for each branch.

- Presentation of receipt numbers should align with the guidelines, such as one receipt number per line or a series of sequential numbers in a line.

- There is no strict requirement for sequential receipt numbers, though the system generally arranges them in sequence automatically.

- Can businesses that have not implemented e-invoicing continue using handwritten receipts (cash bills)?

- Yes, handwritten receipts can still be used.

- However, businesses transitioning to e-Invoice or consolidated e-Invoice will need to manually key in the data into the relevant portal, which may result in additional work.

- Using an accounting system is recommended for better efficiency in the future.

Learn e-invoicing with YYC taxPOD: The Ultimate e-invoicing Course in Malaysia

Malaysia Comprehensive e-invoicing Learning Course Modules

Are you ready to streamline your invoicing processes and ensure compliance with Malaysia’s Inland Revenue Board (LHDN) regulations? The YYC taxPOD e-invoicing Learning Course is the perfect solution for businesses seeking to master the e-invoicing system efficiently and effectively.

Why Choose the YYC e-invoicing Course?

- Comprehensive e-invoicing Learning Modules: Gain a deep understanding of e-invoicing fundamentals, including consolidated e-invoicing, self-billed e-invoices, and transaction workflows.

- Expert Guidance: Learn directly from Malaysia’s leading tax professionals, ensuring your knowledge is practical, accurate, and industry-specific.

- Real-World Applications: Discover how to apply e-invoicing strategies tailored to your business, including API integration with accounting systems.

- Stay Updated: Access monthly updates and live webinars to ensure you’re always informed about the latest e-invoicing regulations.

Who Should Take This e-invoicing Course?

- Business owners preparing to implement e-invoicing in Malaysia.

- Finance and accounting professionals looking to simplify compliance.

- Teams aiming to optimize invoicing systems while staying up-to-date with LHDN requirements.

Enroll in the YYC taxPOD e-invoicing Course today and unlock the knowledge and tools you need to navigate Malaysia’s e-invoicing landscape with confidence.

Level Up Your Tax Game with YYC taxPOD – Malaysia 1st Tax Learning Platform

You can always learn more via the YYC taxPOD platform!

YYC taxPOD is Malaysia’s premier online tax education platform, providing expert guidance from a team of experienced professionals. Access comprehensive tax courses, stay updated on the latest tax laws and regulations, and gain valuable insights to optimize your tax planning.

Visit YYC taxPOD now and sign up for a taxPOD demo!