Ready to Rock e-invoicing? Your Step-by-Step Guide to Create e-Invoices via MyInvois Portal is Finally Here!

What is MyTax and MyInvois Portal Testing Environment?

The MyTax and MyInvois Portal Testing Environments are crucial tools for taxpayers looking to familiarize themselves with Malaysia’s digital tax systems without affecting their actual data. The MyTax Portal Testing Environment provides a safe space to explore the features and functionalities of the MyTax Portal, including the initial login configuration. Once logged in, users can access the MyInvois Portal Testing Environment, which focuses on user profile management and the complete suite of MyInvois Portal functionalities—such as issuing e-invoices, credit notes, debit notes, refund notes, and self-billed issuances. These testing environments are designed to ensure that users can practice and understand the systems thoroughly before engaging with the live platforms.

While the MyInvois portal is now officially live, it is recommended that taxpayers test issuing e-invoices in the testing environment before proceeding with official e-invoice issuance. This way, you can confidently test the system without worrying about potential errors affecting real e-invoices!

Where to Access MyInvois Portal Testing Environment?

The Inland Revenue Board (IRB) has rolled out its first phase of e-invoicing on August 1, 2024. Fellow taxpayers can now try to issue e-Invoices using the sandbox testing environment (for those who are not required to do e-invoicing in the first phase of its implementation), accessible at preprod-mytax.hasil.gov.my, a simulated platform provided by the IRB/LHDN.

This environment allows businesses to practice and familiarize themselves with the e-invoicing system. A lot of people probably don’t know about this yet, which is why I’m breaking it down step-by-step. Hopefully, it helps!

Watch the full video of me creating my first e-Invoice using MyInvois portal in Mandarin to get a visual guide through the process.

Also Watch: Step-by-step guide to create e-Invoice via MyInvois Portal (English)

Benefits of Using the MyInvois Sandbox

- Preparation: The MyInvois Sandbox enables businesses to get ready for the transition to mandatory e-invoicing in Malaysia. By providing a controlled environment, it allows businesses to familiarize themselves with the e-invoicing process and ensure their systems are fully compatible with the MyInvois Portal.

- Training: The sandbox environment is ideal for training employees without the pressure of real transactions. This allows staff to practice generating, submitting, and validating e-invoices, ensuring they are well-prepared and confident in using the MyInvois Portal when the mandatory implementation takes effect.

- Error Reduction: Familiarity with the MyInvois Sandbox reduces the likelihood of errors during actual use. By identifying and rectifying potential issues in the testing phase, businesses can ensure more accurate invoice generation and submission, leading to smoother operations and fewer disruptions.

Step-by-Step Guide to Issuing an e-Invoice

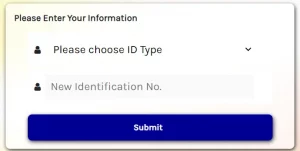

Step 1: Login and Access the Platform

- Visit preprod-mytax.hasil.gov.my.

- Select your identification type.

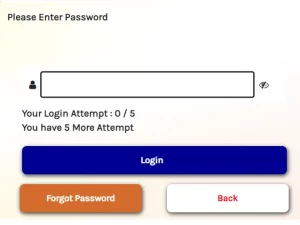

- Enter the required details and password.

- Click Log In.

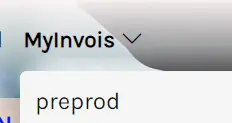

- Hover over MyInvois in the upper left corner and click preprod.

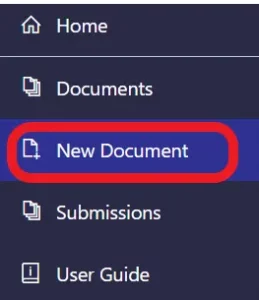

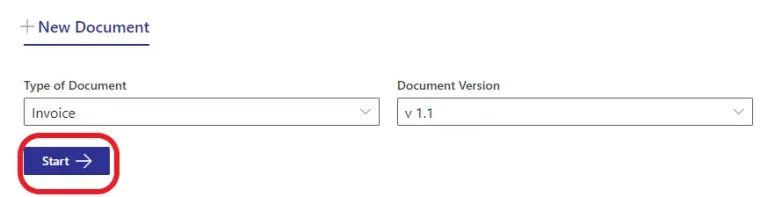

Step 2: Create a new invoice

- On the left side of the page, click New Document.

- Make sure the document type is Invoice and the version is v1.1.

- Click Start.

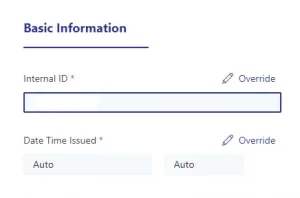

Step 3: Basic Information

- Review the pre-set date and time.

- Click Continue.

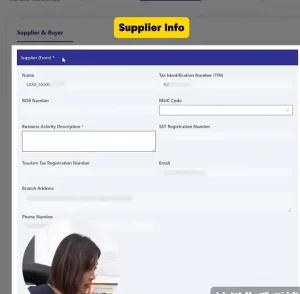

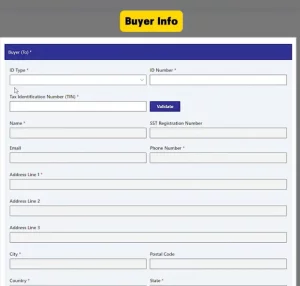

Step 4: Fill in Supplier & Buyer Details

- On the left side of the page, fill in the details of the Supplier.

- On the right side of the page, fill in the details of the Buyer.

- Enter the ID Type, ID Number and the Tax Identification Number (TIN) of the buyer and Validate.

- Enter the buyer’s name.

- (Optional) Enter the buyer’s SST Registration Number.

- (Optional) Enter the buyer’s email address.

- Enter the buyer’s phone number, address, city, country, and state (mandatory fields).

- A green tick will appear beside the Supplier & Buyer tab once all required information is filled in.

- Click Continue.

Step 5: Add Line Items

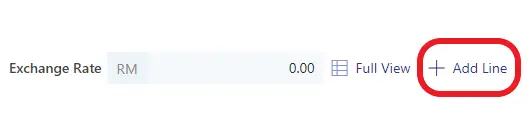

- Select the currency for the invoice (Malaysian Ringgit)

- Click Add Line at the top right corner.

- Fill in the line details (This information is specific to this situation)

Classification code: Others

Product or Service: taxPOD

Quantity: 1 service unit

Unit price: RM2,888

Total Sales Amount (will be calculated automatically)

(Optional) Leave discount blank.

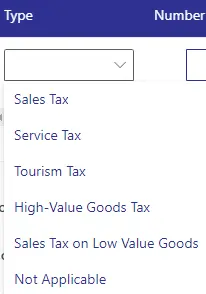

Step 6: Add Taxes (This information is specific to this situation)

- Click Add Tax

- Select Service Tax as the tax type.

- Enter 8% as the tax rate.

- The total tax amount will be calculated automatically.

- Click Add at the bottom right of the page.

Step 7: Review and Finalize

- If you have more line items, click Add Line. Otherwise, click Continue.

- Review the optional fields (frequent billing information, payment and pre-payment information, shipping information).

- Click Continue if not applicable.

- Check the invoice summary for accuracy.

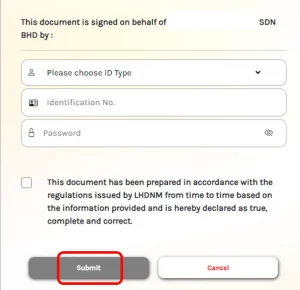

- Click Sign & Submit Document to finalize the e-invoice.

- Enter the required details and click Submit.

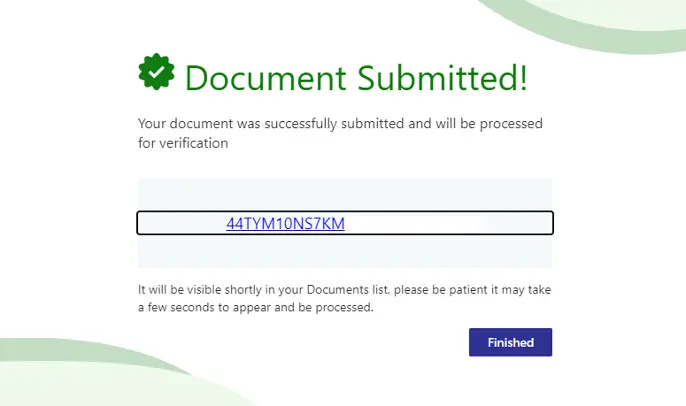

- A pop-up will appear and there will be a link.

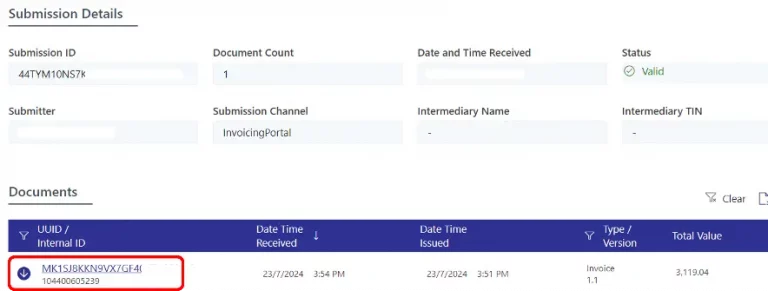

- Click on the link and you will be directed to a page where you will see the submission details.

- Click on the Internal ID and you will see the e-Invoice.

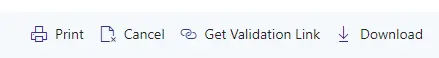

- You can print or download your e-Invoice here.

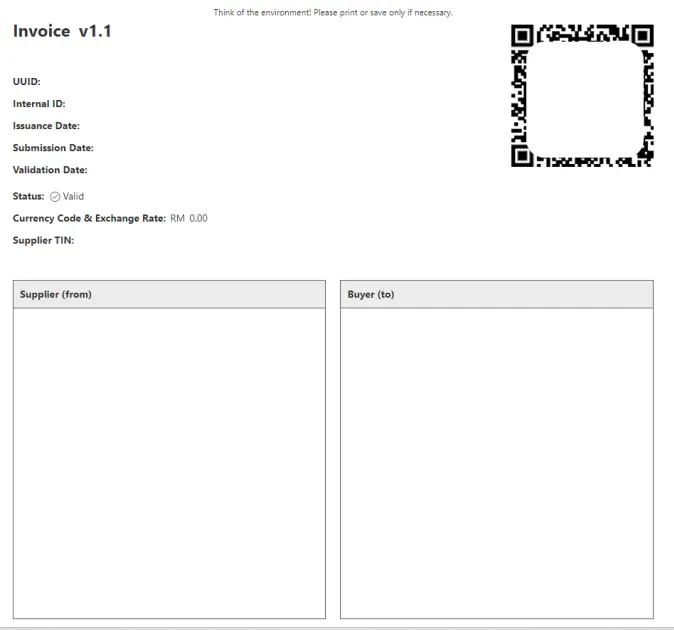

- Click on Print and you will see your e-Invoice like this.

If you found this article helpful, share this valuable information with your friends and family, that will be helpful to them too!

e-invoicing is becoming a mandatory requirement for all businesses in Malaysia. While the full implementation is phased, with larger businesses being the first to adopt, it’s crucial for all business owners to be aware of the upcoming changes.

You can always learn more via the YYC taxPOD platform!

YYC taxPOD is Malaysia’s first all-in-one tax e-learning platform, offering the expertise of a team of professionals at your fingertips. YYC taxPOD offers comprehensive tax education and regular updates on the latest tax laws and regulations.

Visit YYC taxPOD now and sign up for a taxPOD demo!