Tax Expert Articles and Tips for Businesses and Individuals in Malaysia

Explore in-depth articles on various tax-related topics in Malaysia. Gain valuable insights and tips to manage your taxes efficiently, whether you’re an individual or a business owner in Malaysia.

How to Submit Consolidated e-Invoice via MyInvois Portal in Malaysia [Update 2025]

What Is a Consolidated e-invoice? To assist the Suppliers in complying with e-Invoice requirements and to reduce the burden on both Suppliers and Buyers, the

10 Benefits of Complying with e-invoicing in Malaysia for SMEs & MNCs

What is MyTax and MyInvois Portal Testing Environment? In recent years, Malaysia has been advancing its digital economy through various initiatives, one of which is

What are the 5 Types of e-invoice in Malaysia [Latest Update 2025]

1. e-Invoice An e-Invoice is the digital equivalent of a traditional paper invoice. It is an electronic document that outlines the details of a transaction

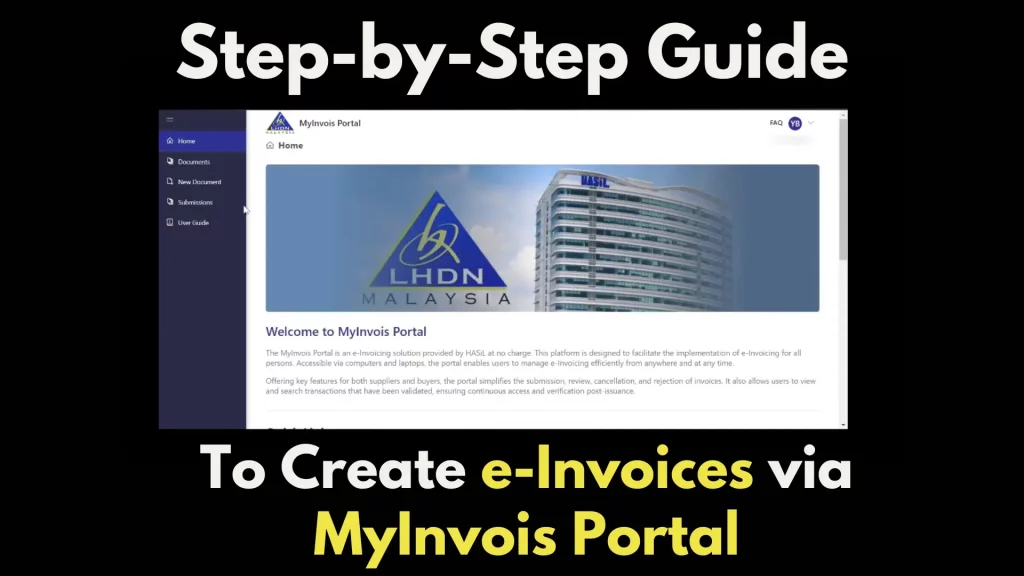

Ready to Rock e-invoicing? Your Step-by-Step Guide to Create e-Invoices via MyInvois Portal is Finally Here!

What is MyTax and MyInvois Portal Testing Environment? The MyTax and MyInvois Portal Testing Environments are crucial tools for taxpayers looking to familiarize themselves with

A Comprehensive Overview of e-invoicing Implementation in Malaysia: Latest Update 2025

In recent years, Malaysia has made significant strides in modernizing its tax administration system. One of the pivotal steps in this direction is the introduction

Tax Relief Tips for Malaysians Earning Over RM6,000: PRS Malaysia, EPF, and Other Tax Reliefs for YA 2024

If you’re earning more than RM6,000 a month, you could significantly reduce your taxes by leveraging the personal income tax reliefs available in Malaysia. From