About Us

Welcome to YYC taxPOD – Malaysia’s No.1 All-in-One

Tax e-Learning Platform for Businesses

YYC taxPOD stands for ‘Tax Professionals On Demand’ reflecting our commitment to providing top-notch tax educational resources. We are here to make tax easy for you, with our extensive range of e-learning courses designed specifically for Malaysian businesses.

Save more, stay compliant, stay informed

Empowering Businesses with Smarter Tax Solutions

We help you to save more, stay compliant with confidence, and keep up with the latest updates so your business stays protected and competitive.

Maximize Tax Savings

Learn proven strategies to reduce tax costs and keep more of your earnings.

Stay Compliant

Meet every tax requirement confidently with accurate and reliable filing.

Latest Tax Updates

Get timely news and rulings so you’re always ahead of changes.

Features at a Glance

Built to Support Your Tax Goals

Discover the core features that make taxPOD an essential platform for anyone looking to stay ahead in tax.

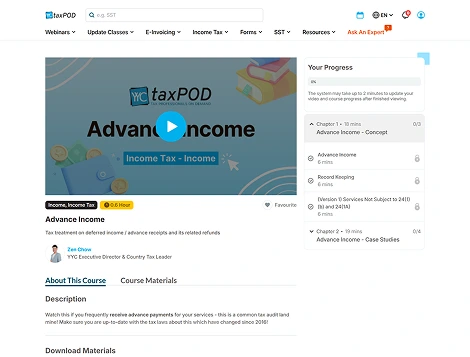

Tax Masterclass Videos

Business-focused tax topics and bite-sized videos with real life case studies

Monthly Tax Update Classes

Latest tax updates from Inland Revenue Board & Royal Malaysian Customs Department every month

Live Tax Webinars

Zoom webinars on various hot tax topics with live Q&A sessions

What Makes Us Different

Why Choose YYC taxPOD?

To get latest updates and news on public rulings in Malaysian Tax

To learn how to maximize tax savings in daily business expenses

To prevent incorrect tax returns to the Inland Revenue Board (IRB)

Experienced tax professionals with in-depth knowledge of Malaysia’s tax laws and rules

Covering various aspects of taxation from Income Tax to Specialized Topics with detailed educational content

To avoid tax penalty and paying more due to incorrect tax returns

Ensure compliance with all tax regulations while optimizing your tax liabilities through our expert guidance and learning resources

Explore Our Courses

Our Tax e-Learning Content

Whether you are looking to master the basics or dive into complex topics, each module is crafted to deliver practical insights you can apply in real-world scenarios.

01

e-Learning Income Tax Malaysia

Comprehensive online courses covering income tax regulations and compliance

02

e-Learning SST Malaysia (Sales and Service Tax)

Learn how to keep your business SST-compliant with in-depth e-learning modules.

03

e-Learning Capital Gains Tax Malaysia

Strategies and insights on managing capital gains tax through detailed e-learning content

04

e-Learning Stamp Duty Malaysia

Understand and comply with stamp duty regulations through our comprehensive online courses

05

e-Learning Personal Tax Relief

Maximize your tax savings with our effective strategies to maximize your tax reliefs

06

e-Learning Corporate Tax Malaysia

Tailored e-learning solutions for effective corporate tax planning and compliance

07

e-Learning Withholding Tax

Learn about the concept of withholding tax, the types of payments subject to it, and how to effectively manage them

08

e-Learning e-Invoice Malaysia

Stay ahead with e-invoicing through our specialized e-invoicing modules

09

e-Learning RPGT (Real Property Gains Tax)

Learn about RPGT calculations and compliance through practical e-learning modules

Our Solutions

Discover the Best-Kept Secrets of Tax Experts

Unlimited Playback of Videos

Business-focused Tax Topics

Practical Case Studies

Up-to-date Tax Planning Strategies

Monthly Tax Update Classes

Latest Tax Updates

Downloadable Course Materials

Live Tax Webinars

Live Q&A Sessions

Trusted and Proven

Our Track Record

See how far we have come in helping professionals and businesses master tax with confidence.

Testimonials

Let’s Hear What Our Clients Said About Us

See how learners across industries have benefited from our expert-led courses and flexible tax learning experience.

Testimonials

Hear It From Our Experts

Our experts share their experiences and perspective on why taxPOD makes a difference.

At taxPOD, we don’t just teach tax, we simplify it so anyone can understand and apply it with confidence.

Tan Wei Ling

Senior Tax Consultant, taxPOD

It’s rewarding to see learners transform their understanding of tax and start making smarter financial decisions.

Ahmad Zulkifli

Tax Specialist, taxPOD

taxPOD allows us to share years of industry experience in a way that’s accessible, practical, and relevant.

Samuel Tan

Tax Consultant, taxPOD

The best part of being a part of taxPOD is seeing our content help businesses stay compliant and save money.

Nurul Izzah

Senior Tax Consultant, taxPOD

Every course we create at TaxPOD is built to solve real tax challenges faced by Malaysians.

Chong Li Wen

Tax Consultant, taxPOD

At TaxPOD, we bridge the gap between complex regulations and everyday understanding

Alex Wang

Senior Tax Consultant, taxPOD

Expert Masterclasses

Access Endless Masterclass from YYC taxPOD Today!

Now that you have seen what taxPOD offers, book a free demo and enjoy a guided walkthrough of the platform and its features.

Need Help? Start Here

Frequently Asked Questions

Browse the most common questions we receive and find answers to help you better understand how taxPOD works.

»Learn How to Get a 100% Tax Deduction!

Example 1: You invited your clients to an event that you organised for a special occasion. Initially, the entertainment expense incurred was only entitled to a 50% tax deduction. However, if you had managed to make it into a sales event with proper planning, then the expenses would have been 100% tax-deductible! That would have made a huge difference!

»Learn How to Strategise Your Tax Estimation!

Example 2:

A customer recently overpaid his tax, which amounted to RM 500k, due to his lack of knowledge in tax estimation. He had no income during the MCO as most of his projects were halted. Unfortunately, the IRB seized his RM 500k cash flow, and he only managed to retrieve it after a very long time.

You should never pay more advance tax than necessary just because you are afraid of getting penalised by the IRB! How do you prevent that from happening? Well, you can learn various tax estimation strategies via our YYC taxPOD platform.

Certificates for course completion are available for download within the platform.

Backed by our commitment to empower entrepreneurial success, YYC Group has served 20,000 clients across Malaysia and Singapore. Through our YYC Business School, we have also trained more than 130,000 participants with more than 5,000 workshops conducted to date.